Newly Minted ETFs Buck Vanguard Effect as Fees Hit Record High

- May 27, 2025

- Category:

(Bloomberg) -- Jack Bogle may have envisioned a world of rock-bottom fees and sleepy index funds — but the ETF market in 2025 looks more like a speculative arcade than a cost-cutting utopia.

Most Read from Bloomberg

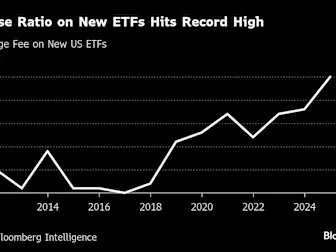

The average fee of an exchange-traded fund launched this year has surged to a record 65 basis points, with leveraged trades, cryptocurrency, and active management among the slew of nearly 350 new offerings, according to a Bloomberg Intelligence analysis.

That means an investor putting $1,000 to work in an ETF would have to pay $6.50 in annual fees — that’s up from last year’s average of under $6 and $4 in 2017.

Paradoxically, the all-time high costs can be linked back to the race toward lower fees among the highest ranks of the ETF league tables. Fund giants like the Bogle-founded Vanguard Group, BlackRock Inc. and State Street Corp. have spent years slashing fees, or expense ratios, on their index-tracking, core portfolio funds to near zero, in an effort to attract new investors.

But as the so-called Vanguard Effect has lowered fees for investors, it in turn has given them the resources to allocate a slice of their portfolios to more expensive, niche funds.

“The scale and efficiency of ultra-low-cost products have helped subsidize the expansion of higher-fee offerings elsewhere, supporting broader innovation and diversification across the ETF landscape,” wrote Bloomberg Intelligence’s Athanasios Psarofagis, in a research note. “As the ETF market matures, issuers are increasingly seeking higher-margin products to bolster profitability.”

Among the freshly minted options this year include: the T-REX 2X Long GME Daily Target ETF, which provides 200% of the daily returns of GameStop Corp. with a 1.5% expense ratio, a fund that provides two times the daily price performance of the XRP crypto token charging 189 basis points and a catastrophe bond ETF at 1.58%.

For asset managers operating in an already low-margin business, the opportunities for profits are now mostly in offerings that use active management, complex strategies and leverage. Assets in single-stock leveraged ETFs, for example, have climbed to a record $22 billion as of mid-May, according to BI data.

The new funds are also “emblematic of the hard right turn we’ve seen,” in a market that’s home to over 4,000 ETFs, says Ben Johnson, head of client solutions at Morningstar Inc., adding that there’s essentially no more room for new equity-index funds.