Analog Semiconductors Stocks Q1 Recap: Benchmarking Monolithic Power Systems (NASDAQ:MPWR)

- June 4, 2025

- Category:

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at analog semiconductors stocks, starting with Monolithic Power Systems (NASDAQ:MPWR).

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 0.9% above.

Luckily, analog semiconductors stocks have performed well with share prices up 15% on average since the latest earnings results.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

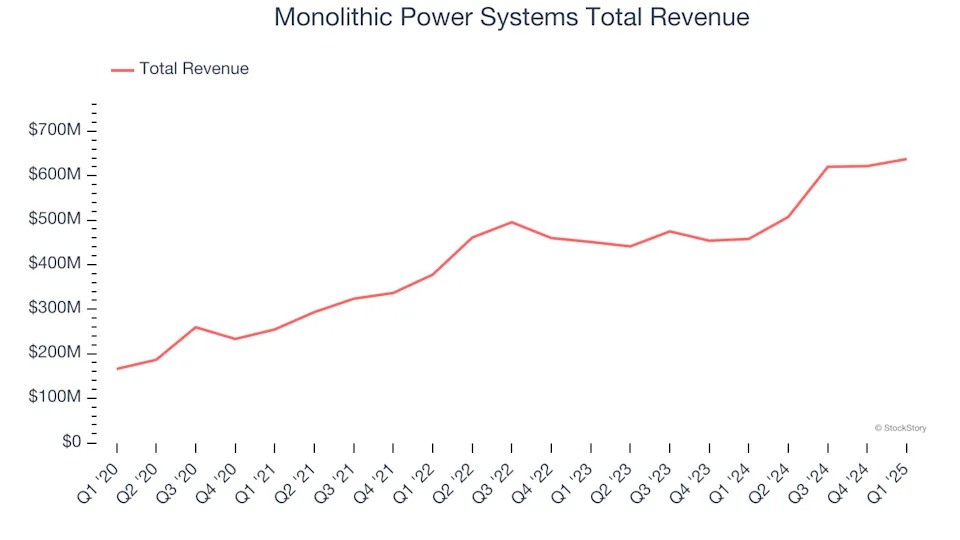

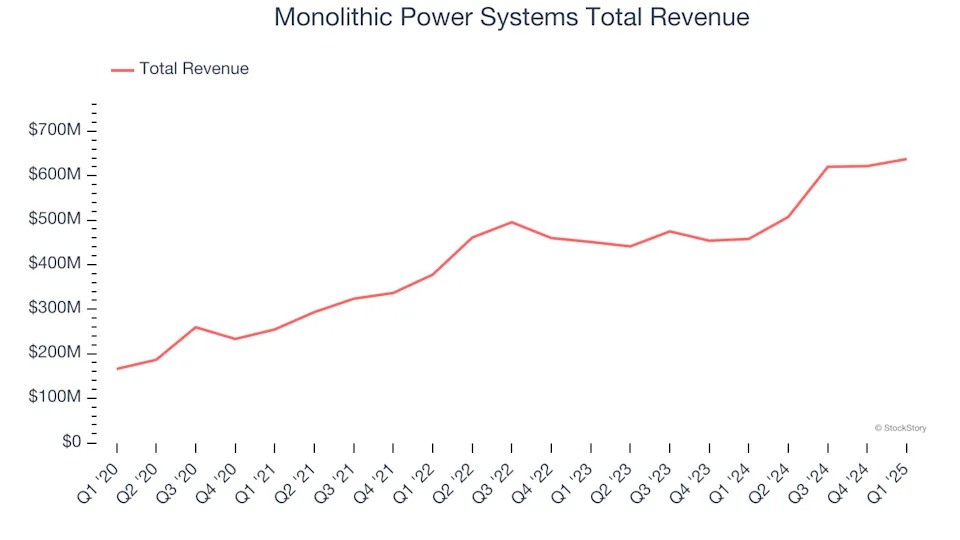

Monolithic Power Systems reported revenues of $637.6 million, up 39.2% year on year. This print exceeded analysts’ expectations by 0.7%. Despite the top-line beat, it was still a mixed quarter for the company with a narrow beat of analysts’ EPS estimates but an increase in its inventory levels.

“Our proven, long-term growth strategy remains intact as we continue our transformation from being a chip-only, semiconductor supplier to a full service, silicon-based solutions provider,” said Michael Hsing, CEO and founder of MPS.

Monolithic Power Systems achieved the fastest revenue growth of the whole group. The stock is up 15.2% since reporting and currently trades at $693.01.

Is now the time to buy Monolithic Power Systems? Access our full analysis of the earnings results here, it’s free .

Best Q1: Himax (NASDAQ:HIMX)

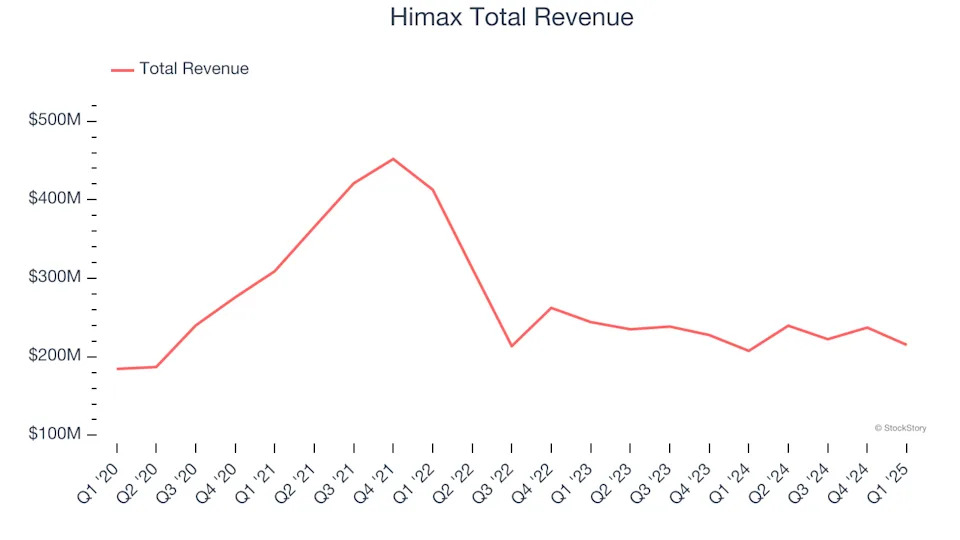

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $215.1 million, up 3.7% year on year, outperforming analysts’ expectations by 2.4%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 14.3% since reporting. It currently trades at $8.53.