Asia Morning Briefing: Coinbase Premium, Not Bank of Japan Rates, Might be the Metric to Watch for BTC

- June 10, 2025

- Category:

Bitcoin BTC is trading at $109.7K as the Wednesday trading day begins in Asia, according to CoinDesk market data.

While the world's largest digital asset is trading flat in the early hours of the session, CoinDesk market data shows that it's up 4% on the week.

An expected Bank of Japan rate cut isn't doing that much to move the market, even though a low interest rate policy is usually what drives risk-on sentiment and positively impacts BTC prices.

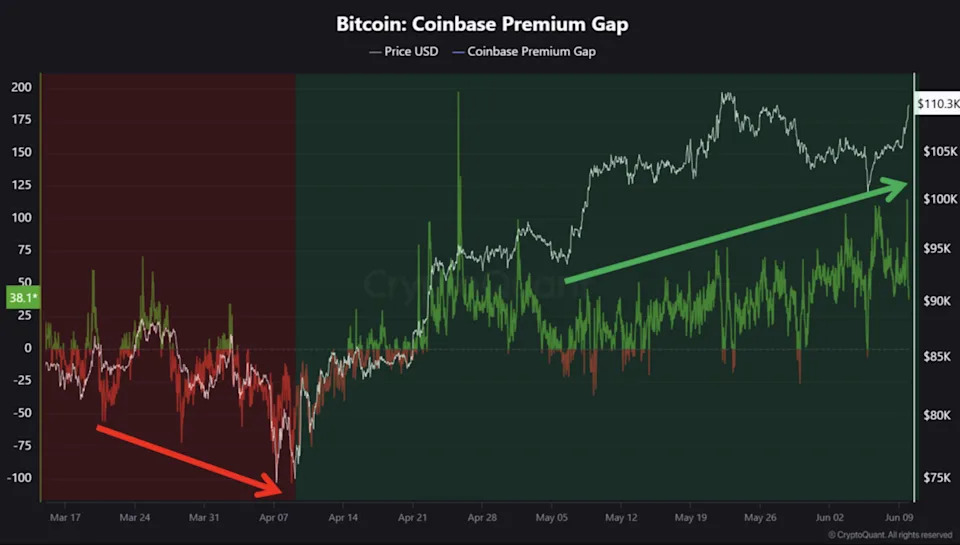

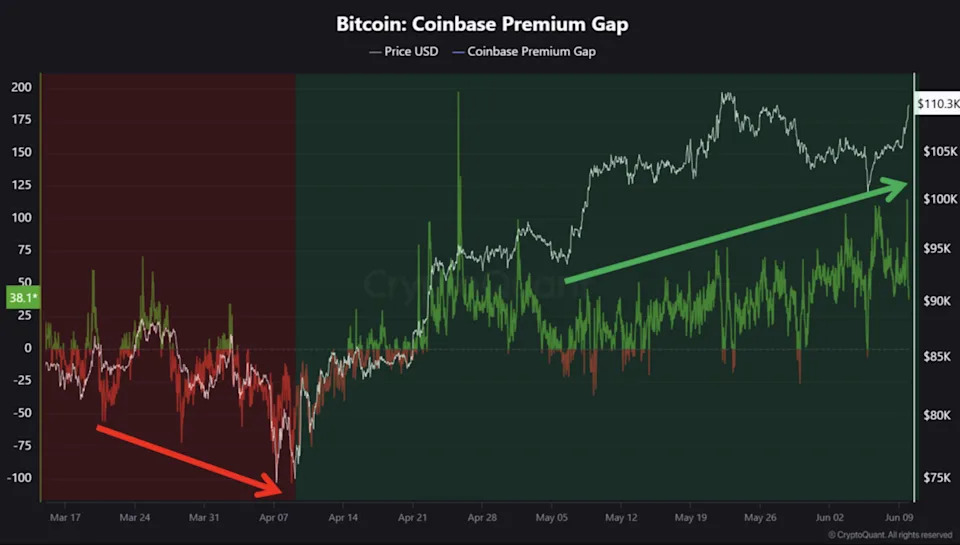

One metric to watch instead is the 'Coinbase Premium'. Tracked by CryptoQuant, it measures the price difference between BTC on Coinbase Pro (USD) and Binance (USDT), demonstrating the dollar demand for bitcoin (as opposed to crypto-native demand).

"The Coinbase Premium is gradually rising, indicating that buying pressure from U.S. investors is supporting the trend," CryptoQuant analysts wrote in a recent update . "Additionally, whale buying activity is being observed incrementally."

Part of this movement would include BTC ETF inflow, which has hit $386.27 million so far this week, according to SoSoValue data .

That being said, some market observers are concerned that a staked ether exchange-traded fund (ETF), which may be close to getting approved , could put a damper on institutional BTC interest.

Youwei Yang, chief economist at BIT Mining, says that an ETF that gives investors access to ETH yield from staking would be something that BTC ETFs can't match, as they just give exposure to price appreciation.

"This has created a lot of buzz, especially considering how much of bitcoin’s rally was fueled by ETF hype," Yang said. "And let’s be honest: while there’s speculation around Solana or Litecoin ETFs, Ether is still the only other crypto asset with a real existence in U.S. spot ETF. That makes it a go-to option for institutions waiting and watching on the sidelines, ready to move when the timing feels right."

But for now, it's still a waiting game. At least until the BoJ's move is official, as the usual crypto-natives like Arthur Hayes are counting on BTC going parabolic as a result.

DEX Volume Has Nearly Doubled in Past Year

Centralized Exchanges (CEXs) have always had their eyes on Decentralized Exchanges (DEXs) since the concept took off in 2018 with the advent of modern Automated Market Maker (AMM) engines – the technology at the center of the product category.

But as the year continues, and crypto mergers and acquisitions heat up maybe there'll be a renewed interest in DEXs, considering the massive jump in volume on the platforms in the last year.