HDV Is a Popular Dividend ETF for Passive Income. But Is It the Best?

- July 1, 2025

- Category:

Key Points

Artificial intelligence (AI), big tech, and cryptocurrencies all have their fans among investors, and with good reason. All can add to a well-balanced portfolio that will help make you richer over time. But you shouldn't forget about income investing -- buying stocks that reward you for holding them by paying a nice, sizable dividend on a regular basis.

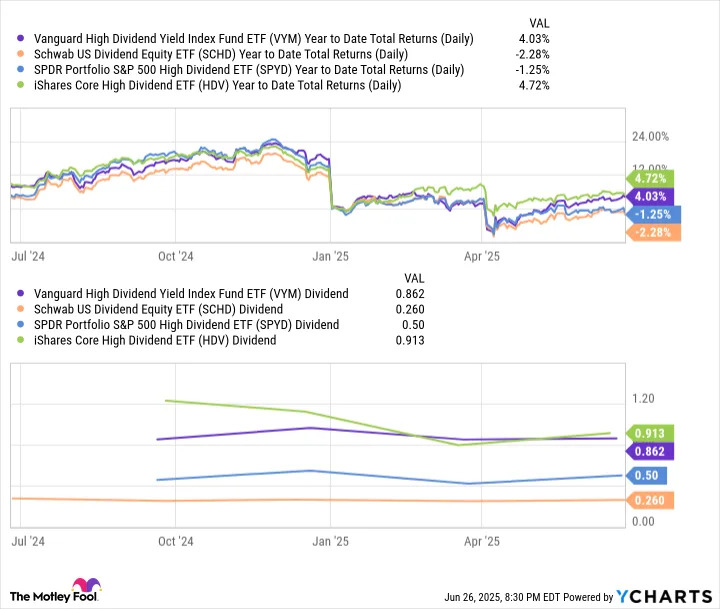

Rather than trying to pick one or two (or 12) dividend stocks, many investors turn to exchange-traded funds (ETFs) to do the heavy lifting. Dividend ETFs are popular go-to options for investors who are seeking a passive income flow. One of the most popular is the iShares Core High Dividend ETF (NYSEMKT: HDV) , a fund that has more than $11 billion in assets and trades roughly 400,000 shares per day.

About the HDV ETF

HDV tracks the Morningstar Dividend Yield Focus Index, which screens for companies with strong balance sheets and a wide economic moat -- exactly what a passive income investor is looking for. It holds 76 stocks, with top holdings including ExxonMobil , Johnson & Johnson , AbbVie , Chevron , AT&T , and Coca-Cola .

Those are important names to know, because fully 50% of the fund is weighed in its top 10 holdings -- that means the fund can be a little overweight toward top names, but those companies are also some of the best dividend stocks you can buy. HDV offers a dividend yield of 3.7% and has a minuscule expense ratio of 0.08, or $8 annually for each $10,000 invested.

But HDV isn't your only option. There are several quality ETFs in the market that offer investors the opportunity to bring in regular income and provide instant diversification. Let's take a look at some of the alternatives:

|

Statistic |

HDV |

SCHD |

VYM |

SPYD |

|---|---|---|---|---|

|

Price-to-earnings ratio |

16.2 |

13.6 |

16.1 |

14.3 |

|

Price-to-sales ratio |

2.3 |

1.4 |

1.7 |

1.3 |

|

Number of equity holdings |

76 |

99 |

585 |

77 |

|

Dividend yield |

3.7% |

3.9% |

2.9% |

4.5% |

|

Expense ratio |

0.08 |

0.06 |

0.06 |

0.07 |

Data sources: Morningstar, author research.

Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) : This fund focuses on stable dividend-paying stocks by tracking the Dow Jones U.S. Dividend 100 Index . With 99 equities in its portfolio, SCHD has a lot of blue chip names, including Chevron, ConocoPhillips , Merck , Texas Instruments , and Cisco Systems . SCHD pays a dividend yield of 3.9%, and its expense ratio is a bit lower than HDV at 0.06.