Asia Morning Briefing: Are Distributed Compute Tokens Undervalued Vs CoreWeave?

- June 30, 2025

- Category:

Tech investors love to pay for potential. GameFi tokens, with sky-high valuations divorced from current user numbers or revenues, embody this optimism perfectly — as CoinDesk investigated in 2022 , Decentraland's then billion-dollar market cap didn't quite match the number of active players on the platform.

But, surprisingly, distributed compute tokens don't seem to enjoy the same speculative premium even when compared to their traditional finance (TradFi) traded peers like CoreWeave (CRWV).

CoinMarketCap says the category of tokens for decentralized networks that provide GPU power for AI and other compute workloads, which includes well-known tokens like BitTensor, Aethir, and Render, is worth $12 billion.

At the same time, market data from research group MarketsandMarkets puts the value of the GPU as a service industry at around $8 billion this year, growing to $26 billion in 2030.

In contrast, CRWV's shares closed at $163 on Monday, putting its market cap at $79.2 billion. The company’s recent earnings forecast up to $5.1 billion in 2025 revenue, suggesting it trades at more than 15 times forward sales.

That kind of multiple might be justified in a high-growth environment, but CoreWeave also posted a $314.6 million net loss in the first quarter , driven in part by stock-based compensation and continued infrastructure buildout.

Despite this, investors continue to reward CoreWeave for its dominant position in centralized AI infrastructure with its stock up 300% year-to-date. The company is tightly integrated with Nvidia and has high visibility through contracts with OpenAI and other enterprise clients.

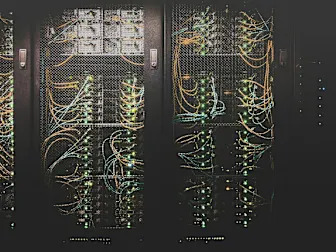

Meanwhile, decentralized compute networks are delivering similar services— AI inference, rendering, and compute power — without needing to raise billions in debt or equity as they act as a broker connecting existing GPUs to users, saving the capital expenditure of buying their own server farms.

These are not theoretical networks. They are functional systems already processing real workloads, and the brokerage model works for customers.

Yet their collective market value remains a fraction of CoreWeave’s. Certainly, they don't have the same level of workload running through their networks, but the gap is striking. While the market treats GameFi with irrational exuberance, distributed compute tokens may be suffering from the opposite problem.

Despite addressing the same market need as CoreWeave, and in some ways offering a more capital-efficient and globally scalable model without the eye-watering CapEx, they remain modestly valued.