NVDA is coming back

- December 19, 2024

- Category: Blockchain

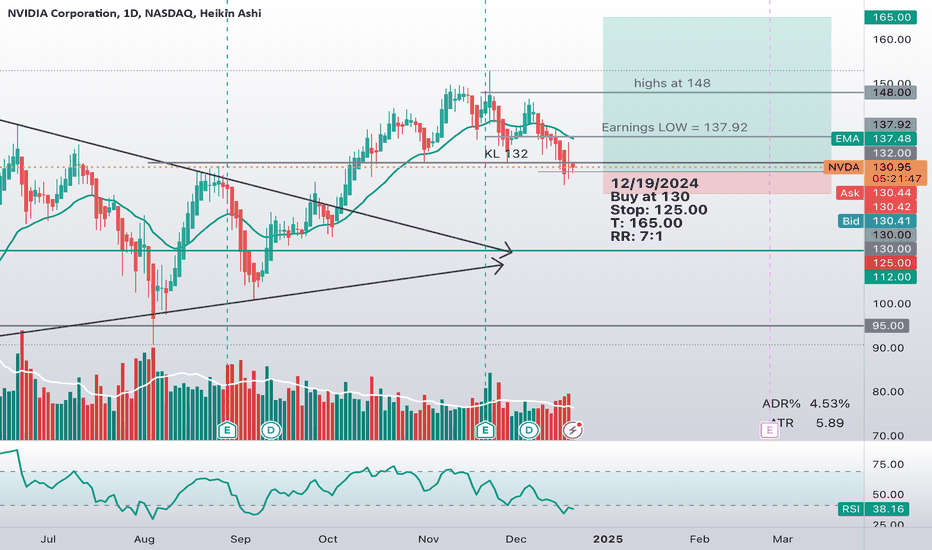

Went below the earnings low but the stock has a strong support around 127 and 132 range. Relative strength is pretty good and it seems like is trying to come back. The fundamentals are still good.

Therefore, I have this trade idea to buy the stock of the 130 with a very tight stop at 125 and my target is 165.

Therefore, I have this trade idea to buy the stock of the 130 with a very tight stop at 125 and my target is 165.

Trade active

The risk to reward to ratio is 7:1 on this one.