Continuation of the Trend

- December 22, 2024

- Category: Blockchain

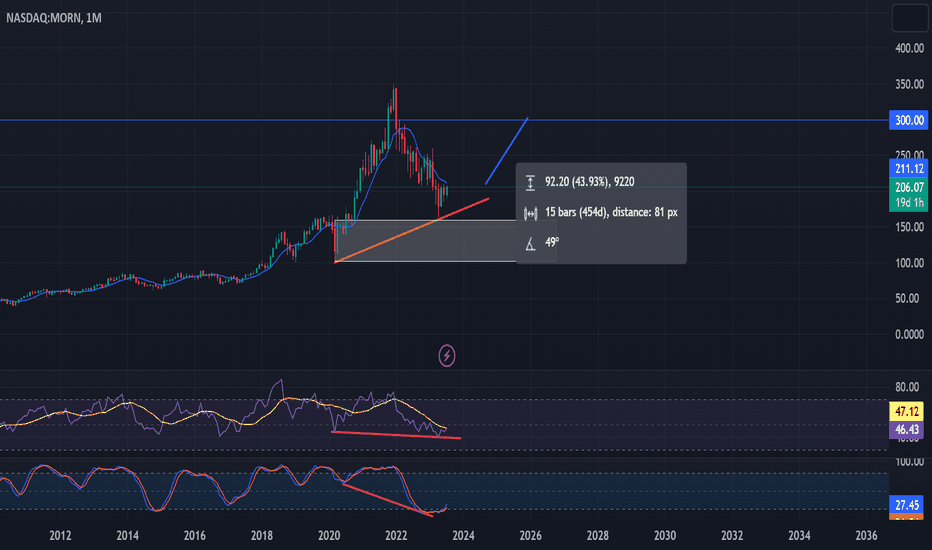

Bullish Divergence on the annual time frame indicating a continuation of the annual trend targeting $300.

Oversold stochastic showing that bears are loosing control and bulls are entering the market gaining the opportunity to earn some sweet dividend pay outs.

RSI indicating Market exhaustion the the downside is over and a bull run is beginning and will continue for the weeks and months ahead.

Enter: $206

SL: $180

Target 1:$250

Target 2: $300

Oversold stochastic showing that bears are loosing control and bulls are entering the market gaining the opportunity to earn some sweet dividend pay outs.

RSI indicating Market exhaustion the the downside is over and a bull run is beginning and will continue for the weeks and months ahead.

Enter: $206

SL: $180

Target 1:$250

Target 2: $300

Trade active

Target hit