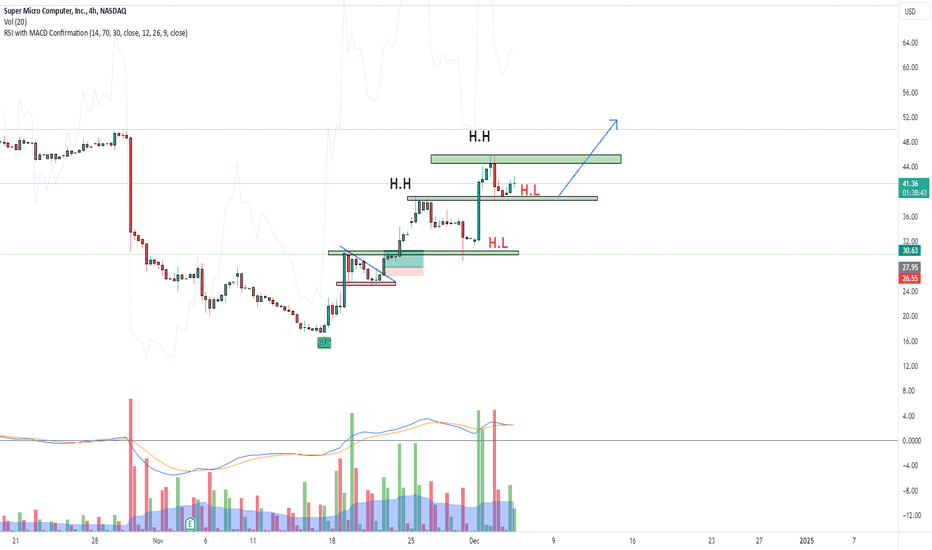

SMCI H.L ?

- December 25, 2024

- Category: Blockchain

Price Action has been playing perfectly.

You can clearly see H.H and HLs being formed. We held support one more time.

Is it ready for a new push higher?

You can clearly see H.H and HLs being formed. We held support one more time.

Is it ready for a new push higher?

Trade active

Beautiful move so far

Trade closed: target reached