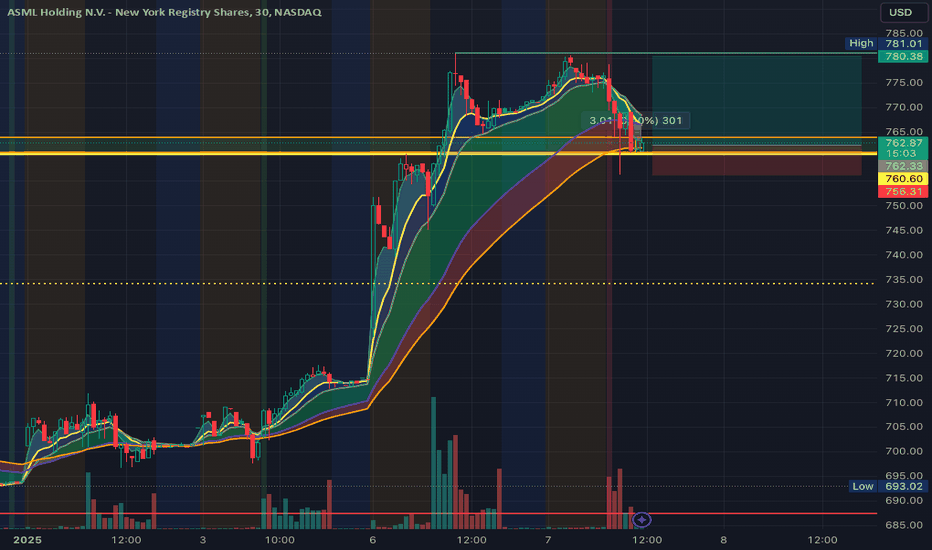

Halftime Update: ASML is looking good for a Continuation Push

- January 7, 2025

- Category: Blockchain

ASML recently broke out to $780 after closing around $715 on January 3rd, 2024. Looking for a potential entry around $762.97 with a stop around the $756.31 Levels and that $780 Price Target.

Connect with us by visiting our website in the signature below to access more Resources & Tools to improve your investments at MyMIWallet #MyMIWallet

Connect with us by visiting our website in the signature below to access more Resources & Tools to improve your investments at MyMIWallet #MyMIWallet

Trade closed: stop reached

ASML tapped our stop loss, as it broke support. With an overall Session Lows across the Markets, this wasn't able to hold. We would be evaluating a potential re-entry but we expect this to retest the $735 levels potentially.