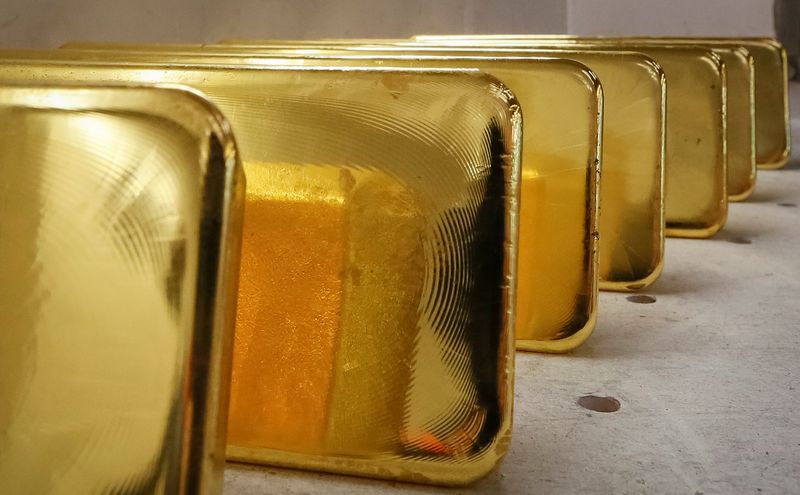

Gold prices pare some gains after hitting fresh record

- February 20, 2025

- Category: Stocks

Investing.com-- Gold prices gave up some gains Thursday, after scaling another record high, but remained supported by a softer dollar on U.S. economic and tariff concerns.

Spot gold rose 0.1% to $2,937.13 an ounce, but had briefly hit a record high of $2,954.89 an ounce earlier in the session.

Gold futures expiring in April rose 0.5% to $2,951.10 an ounce.

Gold buoyed by dollar slump on U.S. economic concerns, Trump tariffs

Walmart (NYSE: WMT ) unveiled an outlook for sales in its 2026 fiscal year that were below forecasts, in a potential sign that the big-box retailer may feel the impact of fading optimism among inflation-hit consumers.

The move sparked concerns about the strength of the U.S. consumer at time when many fear a hit to the economy from a potential trade war.

The dollar fell sharply, boosting demand for yellow-metal.

As well as a weaker dollar, tariff fears continue to underpin safe-haven demand.

Trump on Wednesday said his planned 25% tariffs on automobiles, pharmaceuticals, and semiconductors will be imposed within the coming month.

He also flagged the potential for 25% tariffs on all lumber imports to the U.S.

Trump’s comments ramped up concerns that increased U.S. tariffs will disrupt global trade and spark a renewed trade war between the world’s biggest economies.

The U.S. President had recently threatened to impose reciprocal tariffs on major trading partners. Still, Trump also said on Wednesday that a trade deal with China was possible, even though he recently imposed 10% tariffs on the country, drawing ire and retaliation from Beijing.

Concerns over Trump’s trade policies battered risk-driven markets on Thursday, pushing up demand for safe havens such as gold and the yen. U.S. policy uncertainty has been a key driver of gold’s recent gains.

Other precious metals also advanced, but were nursing some losses this week. Platinum futures rose 1% to $995.65 an ounce, while silver futures rose 0.9% to $33.347 an ounce.

Among industrial metals, copper prices advanced as top importer China kept its benchmark loan prime rate at record lows. Benchmark copper futures on the London Metal Exchange rose 1.1% to $9,551.00 a ton, while March copper futures rose 0.9% to $4.6052 a pound.