Hyperliquid’s HYPE Token: Why Arthur Hayes Thinks It Has 126x Upside Potential

- August 30, 2025

- Category:

Arthur Hayes , the BitMEX co-founder now serving as co-founder and chief investment officer of crypto-focused venture capital firm Maelstrom , says Hyperliquid’s HYPE token could soar more than 100-fold.

Hayes is best known for inventing the perpetual swap at BitMEX, the derivatives contract that changed crypto trading. At Maelstrom, he invests in early-stage infrastructure projects. In his latest blog post , Hayes argued Hyperliquid’s token could rise 126 times, a claim backed by a valuation model produced by Maelstrom.

Hyperliquid is a decentralized exchange built on its own blockchain. Unlike Coinbase or Binance, which are companies running private servers, Hyperliquid lives fully on-chain. Traders use it mainly for perpetual futures — contracts that let them bet on crypto prices without an expiry date.

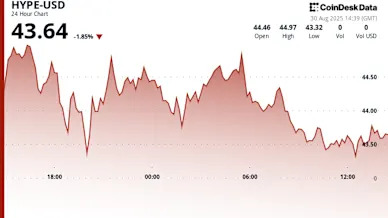

Its native token, HYPE, acts as both a governance tool and an economic stake. Holders can vote on upgrades, stake tokens for rewards and benefit from the way trading fees link to the token’s value. In short, Hyperliquid is the venue and HYPE is how users share in its growth.

'Decentralized Binance'

Hayes begins his case with the big picture.

He says when governments print too much money, currencies lose value and ordinary savers are forced to speculate just to maintain their standard of living. Those who don’t already own houses or stocks see their savings eroded.

For many, especially in emerging markets, the easiest way to save today is with stablecoins such as USDT and USDC — digital dollars that sit natively on blockchains. Once you’re holding stablecoins, Hayes argues, the most obvious place to put them to work is crypto itself, since that’s the system where those tokens function most easily.

That funnel, according to the Maelstrom CIO, leads straight to Hyperliquid. Hayes says it already dominates decentralized perpetual futures trading, controlling around two-thirds of the market and is starting to grow against centralized giants like Binance.

He points to execution as the difference. He believes that Hyperliquid’s small team, led by founder Jeff Yan, ships features faster than rivals with hundreds of employees. The platform feels as fast as Binance, Hayes says, but every step — trading, settlement, collateral management — happens transparently on-chain.

He calls Hyperliquid a “decentralized Binance.” Like Binance, it relies on stablecoins instead of banks for deposits. Unlike Binance, everything is recorded on its blockchain. Hyperliquid’s HIP-3 upgrade also lets outside developers create entirely new markets that plug directly into its order book, turning it into a permissionless trading hub.