Crypto ETF Surge Could Reshape Market, but Many Products May Fail

- August 30, 2025

- Category:

A deluge of crypto exchange-traded funds (ETFs) could hit U.S. markets as early as this fall, potentially changing how both institutional and retail investors access the digital asset space. But while some see it as a turning point for mainstream adoption, others are already bracing for inevitable casualties.

Invest in Gold

“The crypto ETF floodgates are set to open this fall, and investors will soon be swimming in these products,” said Nate Geraci, president of NovaDius Wealth Management. He believes most of the 90-plus crypto ETF applications currently filed with the U.S. Securities and Exchange Commission (SEC) will be approved — assuming they meet the final listing requirements.

Ultimately, though, said Geraci, investors — not regulators — will decide which products thrive.

“The beautiful aspect of the ETF market is that it’s a meritocracy, where investors vote with their hard-earned money. The market naturally sorts out the winners from the losers, so I’m not overly concerned about there being too many crypto ETFs floating around.”

To Geraci, the demand for more diverse and accessible investment options is already there — and underappreciated.

“Given the initial response to futures-based and 1940 Act-structured Solana and XRP ETFs, I believe demand for 1933 Act spot products in these crypto assets is being severely underestimated – much like we saw with spot bitcoin and ether ETFs,” he said.

The iShares Bitcoin Trust (IBIT), managed and issued by BlackRock, became the most successful ETF launch in the history of those vehicles, now holding nearly $85 billion worth of bitcoin on behalf of investors.

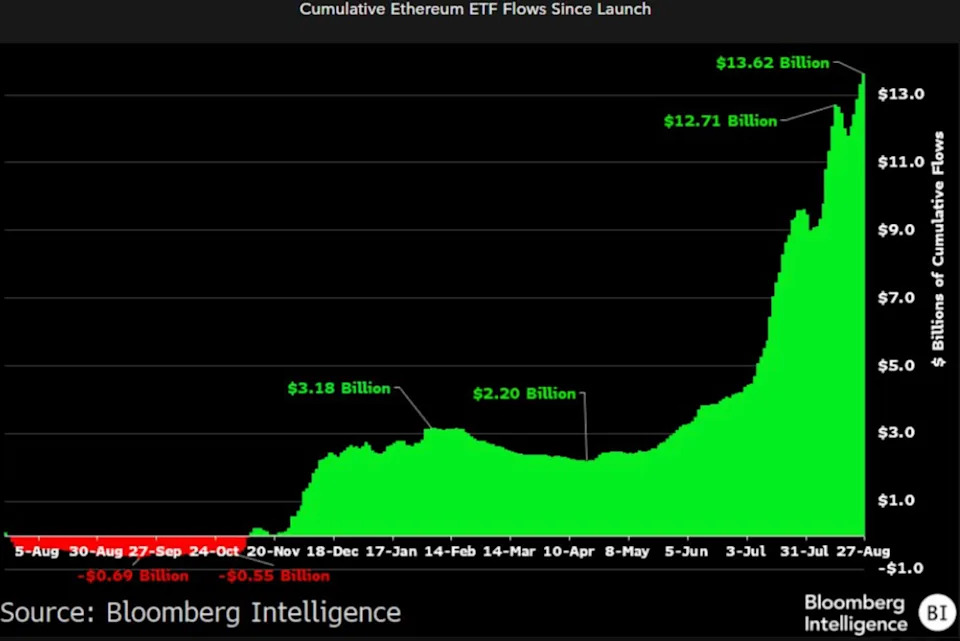

While the ether ETFs initially saw much smaller demand than their bitcoin counterparts, a recent surge in interest in the Ethereum blockchain’s native token has seen inflows for the group well surpass those for bitcoin ETFs.

Ether ETFs have taken in nearly $10 billion since the start of July, which represents the bulk of total inflows of $14 billion since their launch last year, according to James Seyffart, an ETF analyst at Bloomberg Intelligence.

Geraci also anticipates strong uptake for index-based crypto ETFs, which he says will give investors and advisors “a straightforward way to gain exposure to the broader digital asset ecosystem.” For smaller, less-known tokens, he admits demand will depend heavily on the strength of each project’s fundamentals.

“As you move further down the crypto market cap spectrum, I expect demand for spot ETFs will be more closely tied to the success of individual projects and the performance of their underlying assets — factors that are difficult to forecast at this stage,” he said.