UMS Integration's (SGX:558) investors will be pleased with their solid 120% return over the last five years

- September 17, 2025

- Category:

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the UMS Integration share price has climbed 79% in five years, easily topping the market return of 47% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 38% in the last year, including dividends.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

UMS Integration's earnings per share are down 0.8% per year, despite strong share price performance over five years.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

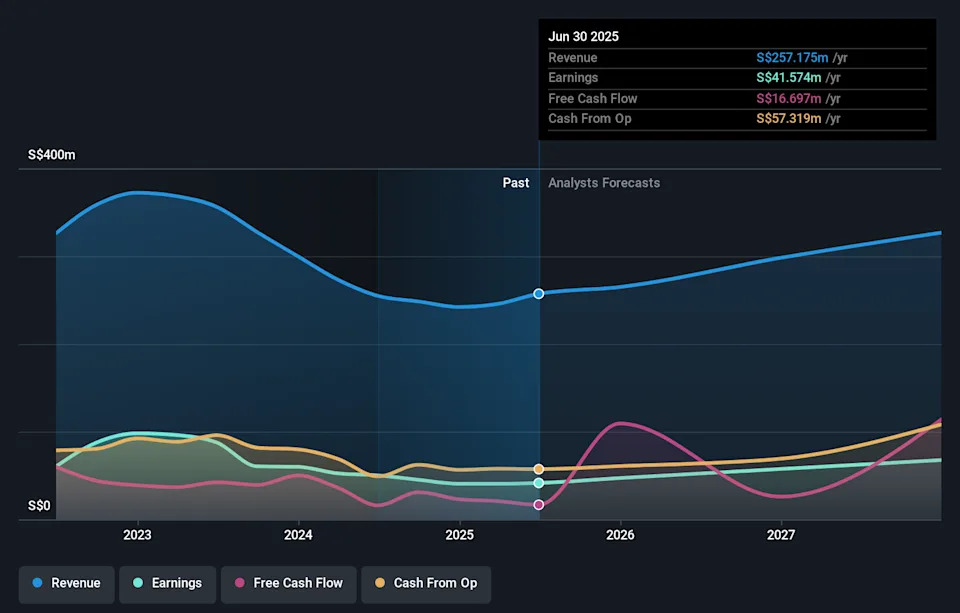

On the other hand, UMS Integration's revenue is growing nicely, at a compound rate of 7.3% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at UMS Integration's financial health with this free report on its balance sheet .

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of UMS Integration, it has a TSR of 120% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.