Reserve powers DTFs to deliver ETF-style investing in crypto

- September 18, 2025

- Category:

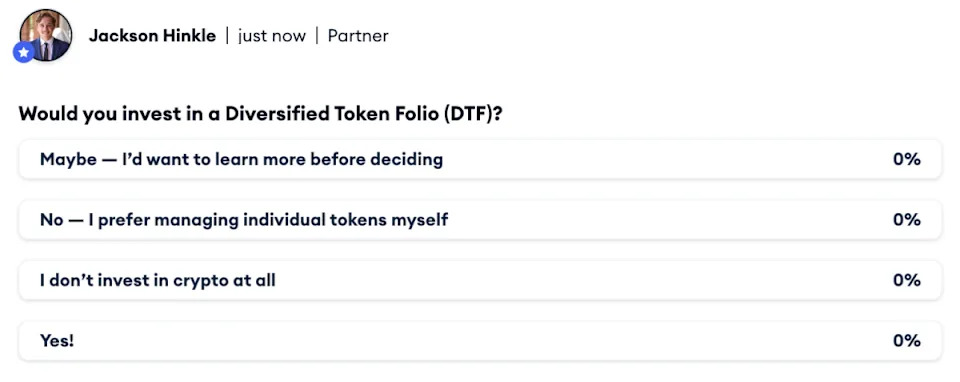

Diversified token folios, or DTFs, are positioning themselves as the crypto world’s answer to traditional ETFs, offering instant exposure to digital assets through a single investment.

Thomas Mattimore, CEO of ABC Labs , the company behind Reserve , speaking with James Heckman on TheStreet Roundtable , explained that the goal is to make crypto investing as seamless as index funds.

“The number one thing that a DTF does for people is the ability to invest in the broad crypto market or specific crypto index or sector in one click and instantly getting that diversified passive crypto market exposure,” Mattimore said.

Expanding platforms for access

For now, the products are available through reserve.org, which hosts a marketplace of crypto indexes. But Mattimore noted the reach is expanding. “People want to access these where they’re used to. Coinbase is now exposing any of the DTFs that are on the Base network, which includes one like the Bloomberg Galaxy Crypto Index,” he explained.

More news

Opening the door for new investors

The DTF format could also broaden crypto adoption by making the market more accessible to retail investors who are unfamiliar with direct token purchases.

Mattimore added that the goal is to bring crypto into the investing mainstream, giving users an easier way to gain exposure without having to manage multiple wallets or tokens themselves.

Reserve acts as a marketplace where people can see how different indexes perform and begin to understand the logic of sector based exposure. By framing crypto in familiar terms, the funds may lower the barrier to entry for retail participants who would otherwise avoid the complexity of wallets and individual tokens.

This story was originally reported by TheStreet on Sep 18, 2025, where it first appeared in the MARKETS section. Add TheStreet as a Preferred Source by clicking here.