Why Robinhood (HOOD) Is Up 9.7% After S&P 500 Inclusion and Expansion Milestones

- October 2, 2025

- Category:

Outshine the giants: these 23 early-stage AI stocks could fund your retirement .

Robinhood Markets Investment Narrative Recap

To be a Robinhood shareholder today, you need to believe the company can successfully broaden its global reach, from prediction markets to banking and tokenized assets, despite recent volatility in growth rates. The latest flurry of milestones may boost optimism for ongoing international expansion, but does not materially change the fact that Robinhood's biggest short-term catalyst is product adoption, while its most immediate risk remains the sustainability of its premium valuation in the face of cooling revenue growth.

Among many announcements, the inclusion of Robinhood in the S&P 500 stands out, lending the company added institutional credibility at a time when expanding user engagement is critical for future growth. Growing volumes in prediction markets reinforce this catalyst, yet they also heighten scrutiny over whether the company can keep up its momentum as competition rises and growth rates fluctuate.

Yet despite robust gains, one risk investors must not overlook is that Robinhood’s rapid product rollout and expansion, while energizing, also brings with it...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets' narrative projects $5.3 billion revenue and $1.8 billion earnings by 2028. This requires 14.0% yearly revenue growth and no earnings change from the current $1.8 billion.

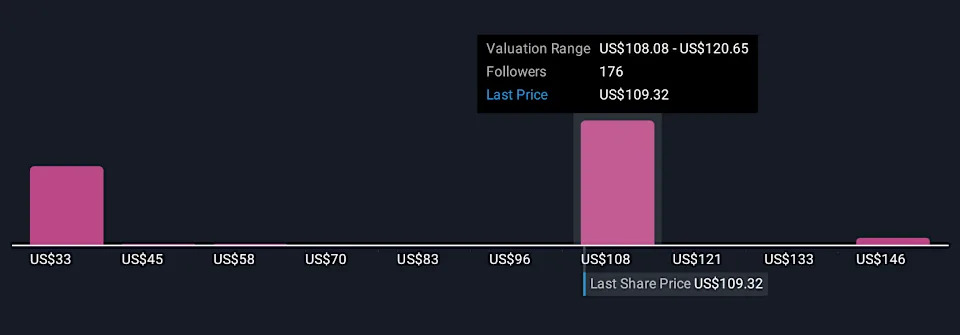

Uncover how Robinhood Markets' forecasts yield a $118.80 fair value , a 15% downside to its current price.

Exploring Other Perspectives

Forty-one estimates from the Simply Wall St Community put Robinhood's fair value between US$38.77 and US$158.37 per share. With high expectations for global product adoption, the range signals that opinions on future growth and valuation can be sharply divided, inviting you to consider a spectrum of alternative viewpoints.