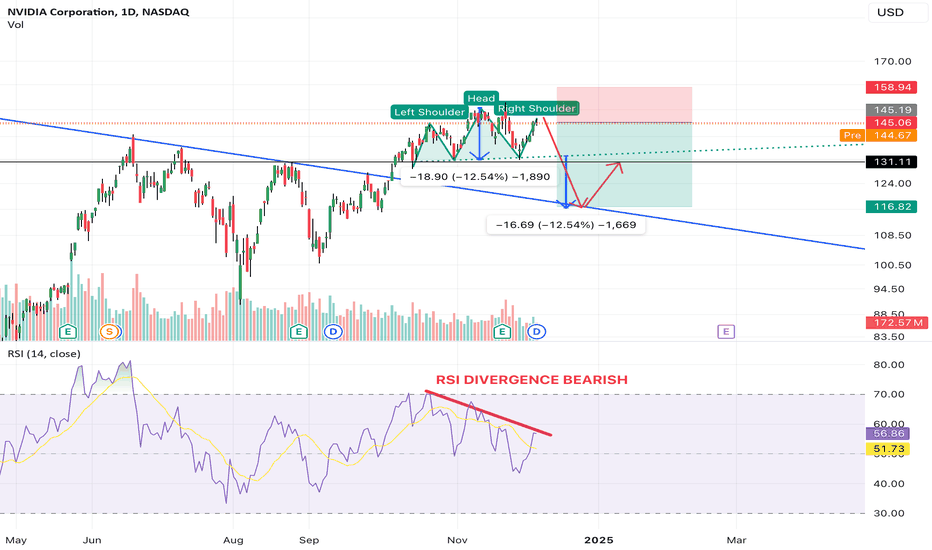

NVDA HEAD N SHOULDERS TOP .

nvda is a perfect candidate for a big short on NVDA, bc is forming an h&s top, RSI divergence, low volume, nosense price action up, is overbought. short n buy with the intraline support.

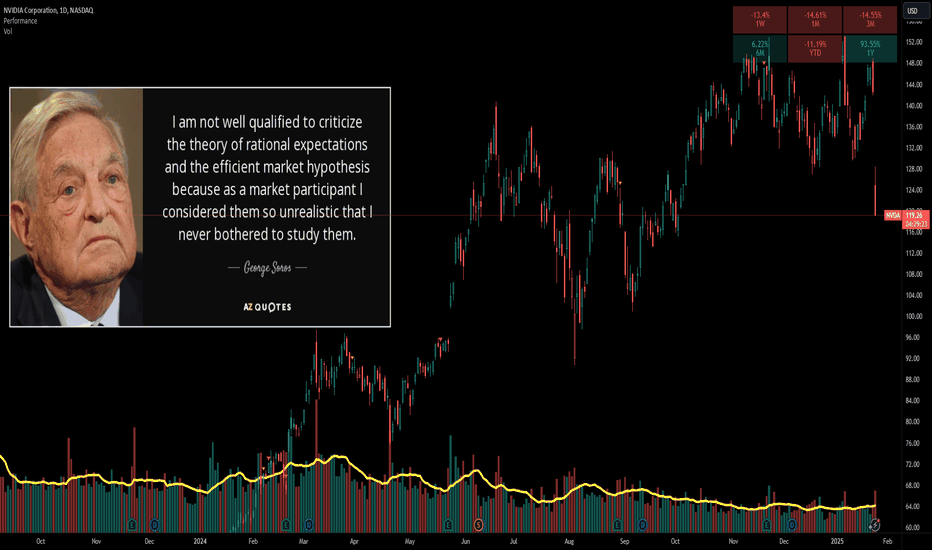

Read MoreDisengage from the herd, Markets are not Rational places!

“The prevailing wisdom is that markets are always right. I take the opposition position. I assume that markets are always wrong. Even if my assumption is occasionally wrong, I use it as a working hypothesis. It does not follow that one should always go against the prevailing trend. On the contrary, most of the time the trend prevails; only occasionally are the errors corrected. It is only on those occasions that one should go against the trend. This line of reasoning leads me to look for the flaw in every investment thesis. ... I am ahead of the curve. I watch out for telltale signs that a trend may be exhausted. Then I disengage from the herd and look for a different investment thesis. Or, if I think the trend has been carried to excess, I may probe going against it. Most of the time we are punished if we go against the trend. Only at an inflection point are we rewarded.” ― George Soros, Soros on Soros: Staying Ahead of the Curve Most people ask themselves why NVDA should lose 15% of its market cap on the news about a Chinese company that claims to have outperformed ChatGPT by spending 5.5 million USD on training their models. I do not care about if the claim is true or not, because I am confident ChatGPT was very hyped, and today the bubble burst. No matter how much everyone in the AI industry and GPU makers trying we will not gain back the trust of people who see their capital melting in front of their eyes!

Read MoreFuntico Launches $TICO Token to Support Gaming Ecosystem

New York, New York, January 27th, 2025, Chainwire Funtico, the full-stack, chain agnostic Web3 gaming platform, announced the launch of its Token Generation Event (TGE), bringing...

Read MoreMovemaker: Aptos Growing Chinese-Speaking Region with Multi-Million-Dollar Support via its Official Community

Hong Kong, Hong Kong, January 27th, 2025, Chainwire The Aptos Foundation proudly announces the establishment of Movemaker, its official community organization. Co-initiated by...

Read MoreCardano Falls 10% In Bearish Trade

- Cardano was trading at $0.8864 by 02:19 (07:19 GMT) on the Index on Monday, down 10.20% on the day. It was the largest one-day percentage loss since...

Read MoreXRP Falls 10% In Selloff

- XRP was trading at $2.8191 by 02:15 (07:15 GMT) on the Index on Monday, down 10.01% on the day. It was the largest one-day percentage loss since...

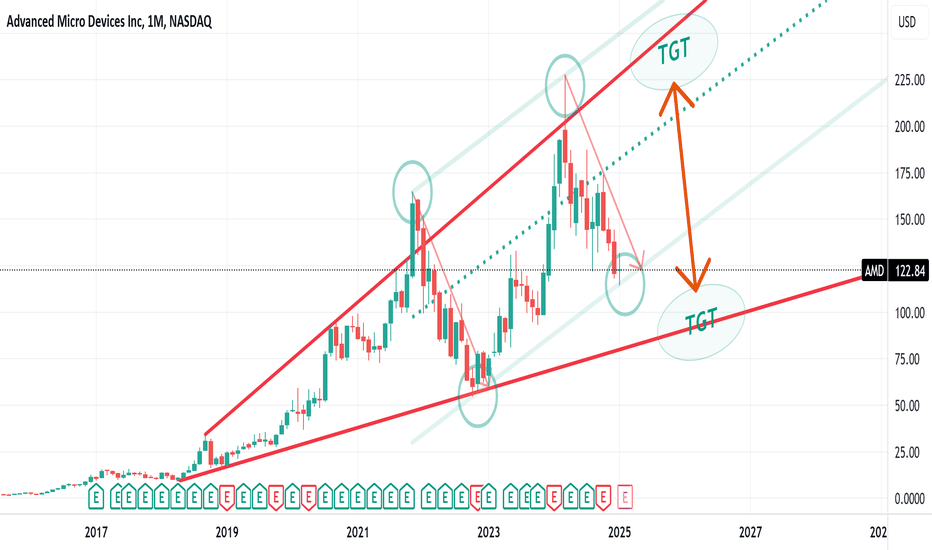

Read MoreAMD'S TLs and Channel

101 Basic trend lines and channels analysis. Red lines are still holding and green channel is holding thus far.

Read MoreLitecoin Falls 10% In Selloff

- Litecoin was trading at $111.583 by 01:38 (06:38 GMT) on the Index on Monday, down 10.14% on the day. It was the largest one-day percentage loss since...

Read MoreEOS Falls 10% In Selloff

- EOS was trading at $0.7331 by 00:51 (05:51 GMT) on the Index on Monday, down 10.12% on the day. It was the largest one-day percentage loss since...

Read MoreBitcoin price today: sinks to $100k as Trump, DeepSeek rattle risk appetite

-- Bitcoin fell on Monday, tracking a broader decline in equity markets as tariff threats from U.S. President Donald Trump rattled risk appetite, while technology...

Read MoreBitcoin (BTC) Wants to Claim $110,000, Ethereum (ETH)'s Crucial Price Battle to Begin, Solana (SOL) on Verge of Skyrocketing?

U.Today - As it continues to test crucial resistance levels, Bitcoin's recent price performance has attracted a lot of attention. BTC is currently trading close to $105,000 and is...

Read MoreModerna Stock Rises on Surprise Q3 Profit

Key Takeaways Moderna shares rose Thursday morning after reporting better results than expected for the …

Read MoreQualcomm Stock Pops on Better-Than-Expected Earnings, $15B Buyback

Key Takeaways Qualcomm posted fiscal fourth-quarter earnings that exceeded analysts’ expectations. The chipmaker also announced …

Read MoreSuper Micro shares plummet after Q4 update raises concerns

Charles Liang, chief executive officer of Super Micro Computer Inc., during the Computex conference in …

Read MoreStellantis to indefinitely lay off 1,100 workers at Jeep plant in Ohio

A view of the Jeep Plant where United Auto Workers members are picketing on September …

Read More