Bitwise files for Dogecoin ETF registration in Delaware

-- Bitwise, a cryptocurrency asset manager, has recently submitted an application to the Delaware's Department of State: Division of Corporations, seeking to register...

Read MoreBybit Unveils 2025 Vision: A User-Centric Approach to Crypto Innovation

Dubai, United Arab Emirates, January 23rd, 2025, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has shared its vision for 2025 during...

Read MoreCrypto sentiment 'very high', getting close to 'extreme euphoria': Needham

-- Needham & Co. said its proprietary 'Crypto Euphoria Needham Diagram' (CEND) reached its highest levels since its inception, indicating that market sentiment for...

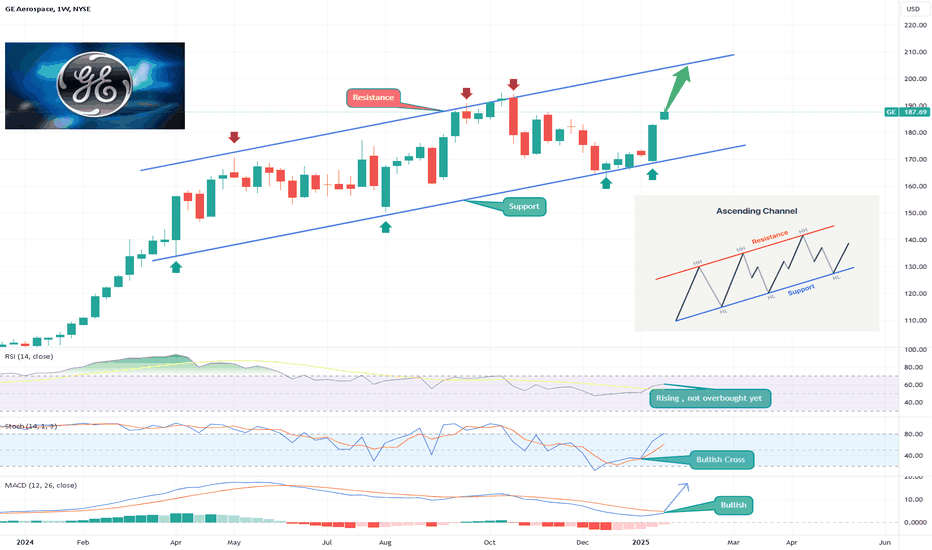

Read MoreGE on the Rise: Bullish Momentum in an Ascending Channel!

Current Price: $187.31 Stop Loss: $166 (below key support). TP1: $195 (near-term resistance). TP2: $210 (channel resistance). TP3: $230 (analyst high target). 🚀Why GE is a Bullish Opportunity 1️⃣ Strong Earnings Potential (Jan 23, 2025) Analysts expect: EPS: $1.03 and Revenue: around $9.85 billion, showcasing year-over-year growth. 2️⃣ Aerospace Momentum Projection: GE Aerospace is on track to achieve an operating profit of $6.7 billion to $6.9 billion for 2024, benefiting from robust demand in both commercial and defense sectors. 3️⃣ Bullish Technicals Technical Indicators: GE stock is trading within a strong upward channel. Indicators like Stochastic (potentially showing bullish crossover), RSI (at a balanced level of 51, suggesting room for growth), and MACD (indicative of bullish momentum) support this view. 4️⃣ Analyst Sentiment Consensus Price Target: Analysts have set an average target of $209.78, with some forecasts reaching up to $230, offering an upside potential of 15% to 23% from the current price of $187.31.

Read MoreNibiru EVM (Nibiru V2) Codebase Finalized Following Rigorous Security Audits

Tortola, British Virgin Islands, January 23rd, 2025, Chainwire Nibiru, a secure and high-performance blockchain, has reached successful code completion for its upcoming Nibiru EVM...

Read More‘American Pickers’ star Mike Wolfe says he held Frank Fritz’s hand when late co-star ‘took his last breath’

“American Pickers” star Mike Wolfe opened up about his final moments with Frank Fritz before …

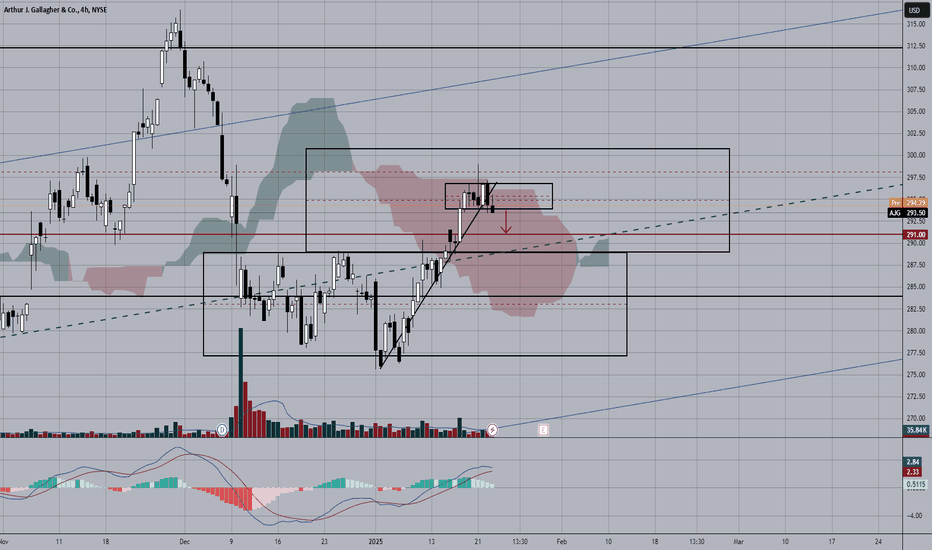

Read MoreArthur J. Gallagher (AJG) TP-$291 SL-$297

Technical Analysis: -Extremely strong resistance (equilibrium zone on the monthly chart) -Pattern of change in movement on the daily chart and a double top in lower timeframes, thus there is an alignment of readings -Strong equilibrium points above $290, which act as technical magnets Indicators: -The Ichimoku Cloud shows solid resistance on the H4 chart, and the cloud cross on the daily chart warns of a possible reversal. -The MACD indicator warns of a probable inflection point on the H4 chart.

Read MoreBybit Launchpool Introduces OBT and SOSO Rewards Through bbSOL Staking

Dubai, United Arab Emirates, January 23rd, 2025, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is pleased to announce new rewards...

Read MoreBitcoin price today: slips to $102k as Trump boost fades, $TRUMP tumbles

-- Bitcoin fell on Thursday after a short-lived rally on hype over more crypto-friendly policies from President Donald Trump, with his recently launched memecoin also...

Read MoreRepublicans score victory in Georgia fight over election observers, RNC chairman says

The Republican National Committee (RNC) is celebrating after GOP poll watchers were allowed into four …

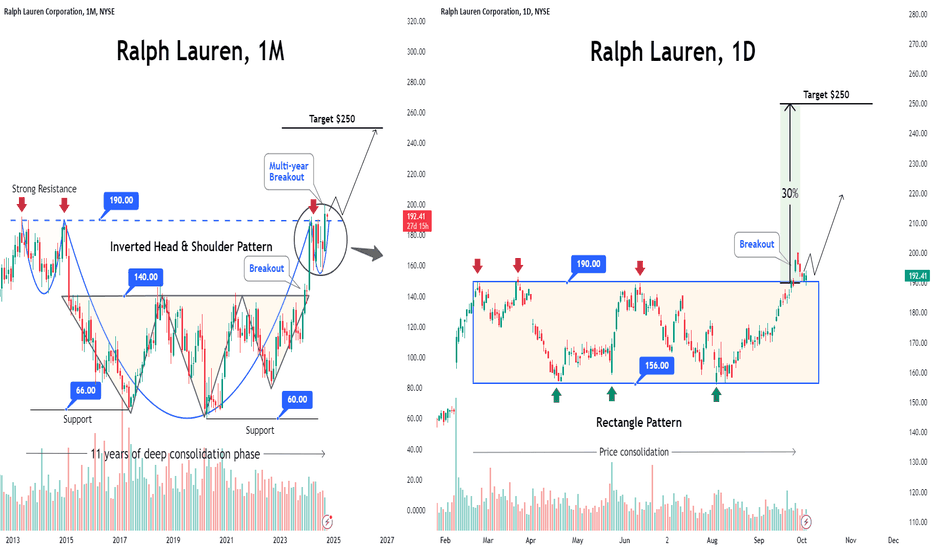

Read MoreRalph Lauren: Elevate Your Wealth with the Essence of Luxury

◉ Abstract Ralph Lauren is thriving in the booming luxury apparel market. The company, founded in 1967, has a market cap of $11.83 billion and generates nearly 44% of its revenue from North America, totaling $2.93 billion. The industry is valued at approximately $110.13 billion in 2024 and projected to reach $151.32 billion by 2029, growing at a CAGR of 6.56%. Recent technical analysis shows Ralph Lauren's stock has outperformed the NYSE Composite index with a 66% annual return. Despite a slight revenue increase of 2.9% year-on-year, EBITDA soared to $1,024 million, reflecting strong financial health. With a current P/E ratio of 17.4x, Ralph Lauren presents an attractive investment opportunity amidst rising global wealth and consumer demand for luxury goods. Read full analysis here . . . ◉ Introduction The global luxury apparel market is currently experiencing significant growth, driven by various factors including increasing disposable incomes, brand loyalty, and the rising influence of social media on consumer behaviour. Here’s a detailed overview of the market size and growth outlook: ◉ Current Market Size According to Mordor Intelligence, the global luxury apparel market was valued at approximately USD 110.13 billion in 2024, with expectations to grow to USD 151.32 billion by 2029, reflecting a CAGR of 6.56%. ◉ Growth Drivers ● Increasing Wealth: The rising number of millionaires globally and growing middle-class affluence, particularly in regions like Asia-Pacific, are significant contributors to luxury apparel demand. ● Consumer Trends: There is a growing perception that luxury goods enhance social status, which fuels consumer interest in high-end fashion. ● Digital Influence: Enhanced online shopping experiences and the effective use of social media for marketing have opened new avenues for luxury brands to reach consumers. ◉ Regional Insights ● Europe Dominant Market: Holds a market share of approximately 34% to 43%. The presence of numerous luxury brands and high purchasing power among consumers drive demand, supported by significant tourist spending on luxury goods. ● North America Strong Demand: The U.S. is a key player, characterized by a wealthy consumer base and increasing brand loyalty, particularly among younger generations who view luxury items as status symbols. ● Asia-Pacific Fastest Growing Market: Anticipated to grow rapidly due to rising disposable incomes and brand awareness, especially in countries like China and India. ● Latin America Emerging Potential: Currently holds a smaller market share but shows promise for growth as consumer awareness and travel increase. ● Middle East & Africa Limited Contribution: This region contributes the least to the luxury apparel market, although countries like the UAE are seeing growth due to tourism. The overall outlook for the luxury apparel market remains optimistic, supported by evolving consumer preferences and increasing global wealth. Amidst the global luxury apparel market's promising growth prospects, we have identified Ralph Lauren as a prime opportunity for investment. With its robust financial performance and impressive technical indicators, Ralph Lauren is well-positioned to propel success. ◉ Company Overview Ralph Lauren Corporation NYSE:RL is a renowned American fashion company known for its high-quality, luxury lifestyle products. Founded in 1967 by the iconic designer Ralph Lauren, the company has become a global symbol of timeless style and sophistication. The company offers a wide range of products, including apparel, footwear, accessories, home goods, fragrances, and hospitality. Ralph Lauren's iconic polo shirt and strong brand identity have contributed to its success, making it a global leader in the luxury fashion industry. ◉ Investment Advice 💡 Buy Ralph Lauren Corporation NYSE:RL ● Buy Range - 190 - 193 ● Sell Target - 245 - 250 ● Potential Return - 27% - 30% ● Approx Holding Period - 8-10 months ◉ Market Capitalization - $11.83 B ◉ Peer Companies ● Tapestry NYSE:TPR - $10.59 B ● Levi Strauss NYSE:LEVI - $8.57 B ● PVH Corp. NYSE:PVH - $5.44 B ● Columbia Sportswear Company NASDAQ:COLM - $4.87 B ◉ Relative Strength The chart clearly illustrates that Ralph Lauren has greatly outperformed the NYSE Composite index, achieving an impressive annual return of 66%. ◉ Technical Aspects ● Monthly Chart ➖ The monthly chart clearly shows that the stock price faced several rejections near the 190 level, which ultimately triggered a significant drop, brought the price down to the 66 level. ➖ Afterward, the price experienced various fluctuations and, after a prolonged consolidation phase, developed an Inverted Head & Shoulders pattern. ➖ Upon breaking out, the price surged upward but encountered resistance again at the previous resistance zone. ➖ However, after a pullback, the stock has successfully surpassed this resistance for the first time in almost 11 years. ● Daily Chart ➖ On the daily chart, the price has formed a Rectangle pattern following a brief consolidation phase and has recently made a breakout. ➖ If the price can hold above the 190 level, we can expect a bullish movement in the coming days. ◉ Revenue Breakdown - Location Wise Ralph Lauren Corporation is a global luxury brand with a strong presence in various regions. ➖ North America remains Ralph Lauren's biggest market, contributing nearly 44% of its total revenue, which amounts to $2.93 billion. ➖ In Europe , the brand is seeing consistent growth, with revenue reaching around $2 billion, making up about 30% of total earnings. ➖ Asia , especially China, is becoming a key player for Ralph Lauren, generating approximately $1.58 billion, or 24% of total revenue. ◉ Revenue & Profit Analysis ● Year-on-year ➖ In the fiscal year 2024, the company achieved a modest revenue increase of 2.9%, totaling $6,631 million, compared to $6,443 million in the prior year. ➖ On the other hand, EBITDA growth has been remarkable, soaring to $1,024 million from $801 million in FY23. The current EBITDA margin stands at an impressive 15.5%. ➖ Additionally, diluted earnings per share (EPS) experienced a substantial year-over-year rise of 28%, reaching $9.71 in FY24, up from $7.58 in FY22. ● Quarter-on-quarter ➖ In terms of quarterly performance, the company reported a decline in sales over the last three quarters, with the most recent quarter showing sales of $1,512 million, down from $1,568 million in March 2024 and $1,934 million in December 2023. ➖ Nevertheless, EBITDA demonstrated significant growth in the June quarter, climbing to $265 million from $176 million in March 2023. ◉ Valuation ● P/E Ratio ➖ Current P/E Ratio vs. Median P/E Ratio The current price-to-earnings ratio for this stock stands at 17.4x, which is notably elevated compared to its four-year median P/E ratio of 5.7x. This suggests that the stock is presently overvalued. ➖ Current P/E vs. Peer Average P/E When evaluating the stock's Price-To-Earnings Ratio of 17.4x, it shows a more attractive valuation, as it is lower than the peer average of 25.5x. ➖ Current P/E vs. Industry Average P/E RL is positioned at a more appealing price point, with a Price-To-Earnings Ratio of 17.4x, which is significantly less than the US Luxury industry's average of 19.x. ● P/B Ratio ➖ Current P/B vs. Peer Average P/B The current P/B ratio reveals that the stock is considerably higher than its peers, with a ratio of 5x compared to the peer average of 3x. ➖ Current P/B vs. Industry Average P/B In comparison to the industry average, RL's current P/B ratio of 5x indicates that it is substantially overvalued, as the industry average is only 2.2x. ● PEG Ratio A PEG ratio of 0.54 suggests that the stock is undervalued relative to its expected earnings growth. ◉ Cash Flow Analysis In fiscal year 2024, operational cash flow experienced remarkable growth, reaching $1,069 million, a substantial increase from $411 million in fiscal year 2023. ◉ Debt Analysis The company currently holds a long term debt of $1,141 million with a total equity of $2,367 million, makes long-term debt to equity of 48%. ◉ Top Shareholders ➖ The Vanguard Group has significantly increased its investment in this stock, now owning an impressive 8.23% stake, which marks a 3.9% rise since the end of the March quarter. ➖ Meanwhile, Blackrock holds a stake of around 4.11% in the company. ◉ Conclusion After a thorough evaluation, we find that Ralph Lauren Corporation is strategically poised to thrive in the expanding luxury apparel market, driven by increasing disposable incomes and a growing appetite for high-end products.

Read More