Donald Trump's memecoin hovers around $11 bn market cap ahead of inauguration

-- Trump's new cryptocurrency surged prior to his inauguration as the 47th president of the United States, giving it a market value of almost $11 billion. The crypto...

Read MoreMEXC Introduces Contract Address Search to Streamline Memecoin Trading Navigation

Seychelles, Seychelles, January 20th, 2025, Chainwire MEXC, a global leader in cryptocurrency trading platforms, has officially announced the launch of the Contract Address...

Read MoreChinese EV maker BYD’s quarterly sales overtook Tesla’s for the first time

New cars, among them new China-built electric vehicles of the company BYD, are seen parked …

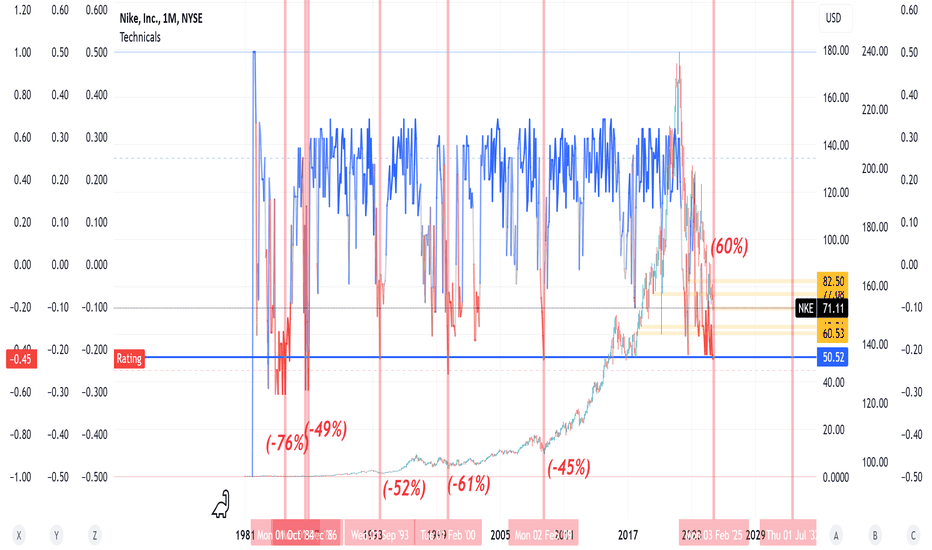

Read MoreNike's Technical rating "Indicator" since day one is flashing!

The only other time we have had such a low readings we had (-76%) drawdown, we are setting on (-60%) this week therefore the risk down is another 16% correction. I have copied the following from Tradingview website to give u an insight on this indicator ! " Definition Technical Ratings is a technical analysis tool that combines the ratings of several technical indicators to make it easier for traders and investors to find profitable trades. Calculations These are the criteria used to determine the rating of the individual indicators used. Note that changes from the last bar are used to determine falling or rising states: All Moving Averages Buy — MA value < price Sell — MA value > price Neutral — MA value = price Ichimoku Cloud Buy — lead line 1 > lead line 2 and base line > lead line 1 and conversion line > base line and price > conversion line Sell — lead line 1 < lead line 2 and base line < lead line 1 and conversion line < base line and price < conversion line Neutral — neither Buy nor Sell Relative Strength Index Buy — indicator < 30 and rising Sell — indicator > 70 and falling Neutral — neither Buy nor Sell Stochastic Buy — main and signal lines < 20 and main line > signal line Sell — main and signal lines > 80 and main line < signal line Neutral — neither Buy nor Sell Commodity Channel Index Buy — indicator < -100 and rising Sell — indicator > 100 and falling Neutral — neither Buy nor Sell Average Directional Index Buy — +DI line > -DI line and indicator > 20 and rising Sell — +DI line < -DI line and indicator > 20 and rising Neutral — neither Buy nor Sell Awesome Oscillator Buy — saucer and values are greater than 0, or cross over the zero line Sell — saucer and values are lower than 0, or cross under the zero line Neutral — neither Buy nor Sell Momentum Buy — indicator values are rising Sell — indicator values are falling Neutral — neither Buy nor Sell MACD Buy — main line values > signal line values Sell — main line values < signal line values Neutral — neither Buy nor Sell Stochastic RSI Buy — downtrend and K and D lines < 20 and K line > D line Sell — uptrend and K and D lines > 80 and K line < D line Neutral — neither Buy nor Sell Williams Percent Range Buy — indicator < lower band and rising Sell — indicator > upper band and falling Neutral — neither Buy nor Sell Bulls and Bears Power Buy — uptrend and BearPower < zero and BearPower is rising Sell — downtrend and BullPower > zero and BullPower is falling Neutral — neither Buy nor Sell Ultimate Oscillator Buy — UO > 70 Sell — UO < 30 Neutral — neither Buy nor Sell The numerical value of the Sell rating is -1, Neutral is 0 and Buy is 1. The group and overall ratings are calculated as the average of the ratings of the individual indicators. Recommendations for the group or overall ratings are based on this numerical rating value and determined according to the following criteria: — Strong Sell — Sell — Neutral — Buy — Strong Buy The basics The recommendations given by the indicator are based on the ratings calculated for the various indicators included in it. The overall rating of the indicator includes two large groups of indicators. The first consists of SMAs and EMAs with different lengths (MA lengths are 10, 20, 30, 50, 100 and 200), the Ichimoku Cloud (9, 26, 52), VWMA (20) and HullMA (9). The second one is calculated on the following oscillators: RSI (14), Stochastic (14, 3, 3), CCI (20), ADX (14, 14), AO, Momentum (10), MACD (12, 26, 9), Stochastic RSI (3, 3, 14, 14), Williams %R (14), Bulls and Bears Power and UO (7,14,28). Each group's rating is calculated separately, so you can select the group in the indicator settings and its respective rating calculation will be displayed on the chart. What to look for The Technical Ratings tool is designed to have values that fluctuate above and below a zero line. Its values are plotted as a histogram of red, blue and gray bars, and depend on your selection in the Rating is based on field of the script's inputs, where you can choose to view the value of the MAs rating, the oscillators rating, or the average of both. Columns are gray when the value of the indicator is between 0.1 and -0.1. Progressively more saturated blue columns indicate rising values above 0.1, and more saturated red columns indicate progressively falling values below -0.1. The label at the end of the histogram displays the state of the MAs, oscillators, and the overall rating. Its color is determined by the value of the rating selected in the Rating is based on field: gray for neutral, blue for Buy or Strong Buy, red for Sell or Strong Sell. Summary Technical Ratings can be a valuable technical analysis tool for many analysts or traders. Many traders use a selection of complementary indicators to make better decisions. Technical Ratings simplifies this task by combining the most popular indicators and their signals. Note: TradingView does not recommend that anyone buy or sell any financial instrument based solely on the recommendations of the Technical Ratings indicator. Recommendations merely indicate the fulfillment of certain conditions of a set of individual indicators that may help the user to spot potentially favorable conditions for a transaction, if this is consistent with his/her strategy. " end of copy !

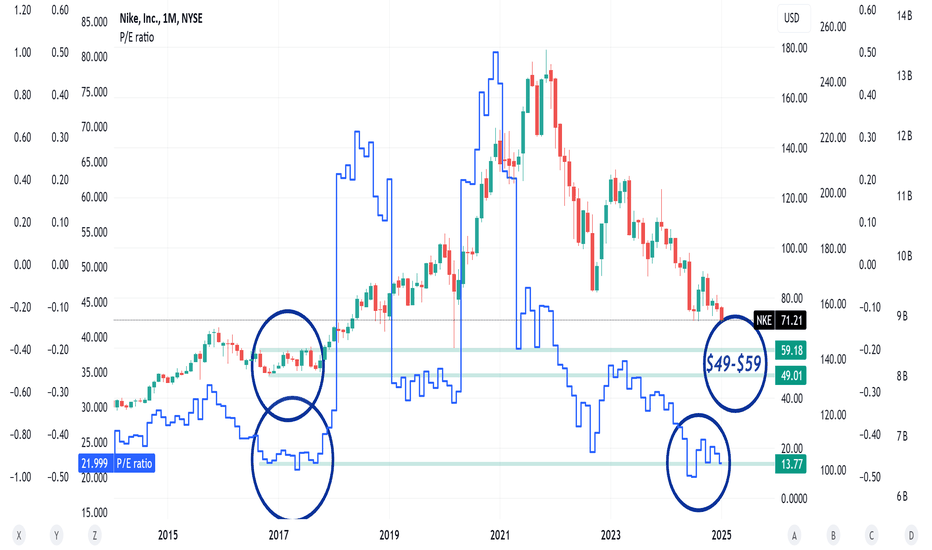

Read MoreNike Price Earnings Ratio is similar to 2017 or not ?

Quoting P/E Ratio meaning: Investopedia " What Is the Price-to-Earnings (P/E) Ratio? The price-to-earnings (P/E) ratio measures a company's share price relative to its earnings per share (EPS). Often called the price or earnings multiple, the P/E ratio helps assess the relative value of a company's stock. It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market." end of quote

Read MoreBiggest Bitcoin (BTC) Price Test Incoming, XRP Remains Dominant: Eyes For $3.5, 45% Solana (SOL) Pump Might Be Only Beginning

U.Today - With a recent break above a crucial resistance level close to $102,000 Bitcoin is still gaining ground. Although this move suggests that the asset is once again strong a...

Read MoreBitcoin price today: rallies to record high over $109k before Trump inauguration

-- Bitcoin rebounded from early losses on Monday, racing to a record high as traders piled into the world's largest cryptocurrency in anticipation of friendlier crypto...

Read MoreEvo Morales Says Venezuela Is Aiding Socialist Blockades Starving Bolivia

Bolivia’s socialist former president Evo Morales, wanted on charges of pedophilia, claimed on Tuesday that …

Read MoreTrump Crushes Harris in Maine Student Mock Election Known for Accurate Predictions

Thousands of students across 138 Maine schools voted in a mock election on Tuesday, with …

Read MoreTrump's new crypto token jumps ahead of his inauguration

SINGAPORE (Reuters) - Donald Trump's newly minted cryptocurrency soared on Monday to top $9 billion in market value, drawing in billions in trading volume just hours ahead of the...

Read MoreMeta Says It’s ‘Making a Lot of Progress’ With AI as Spending Grows

Meta Platforms (META) CEO Mark Zuckerberg said in Wednesday’s earnings call that more spending on …

Read MoreDown 14% After Earnings, Should You Buy the Dip in This Gold Stock?

Switch the Market flag for targeted data from your country of choice. Open the menu …

Read MoreMeta Q3 earnings report 2024

Meta reported weaker-than-expected user numbers and warned of a significant acceleration in its infrastructure expenses …

Read More