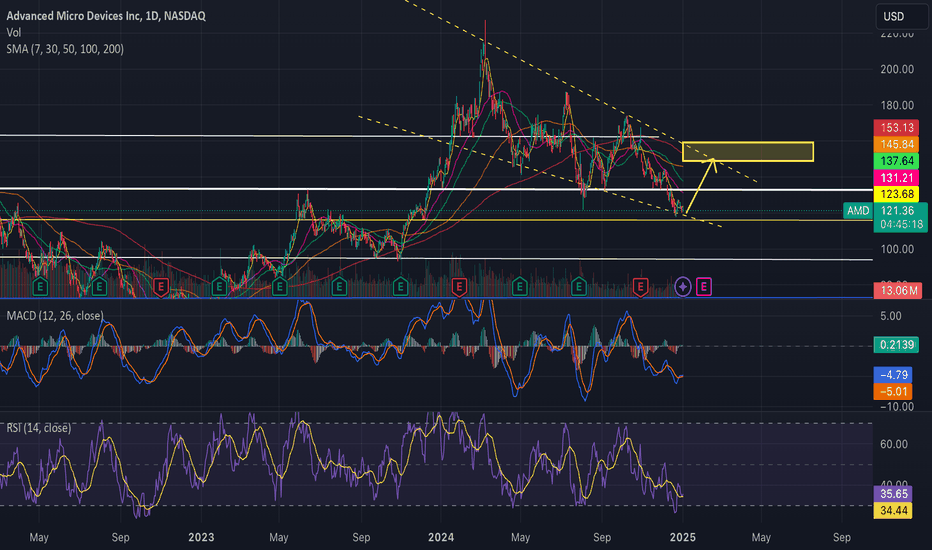

AMD coiling to $148-160 range by post-earnings

- NASDAQ:AMD is one of the beaten down names. It's not too cheap at the current valuation but it's growth for upcoming 2-3 years are promising which deserves a higher multiple. - 25%+ growth rate when revenue is in billions is a big deal unlike NASDAQ:PLTR which has high 20s % growth rate on a revenue of 250 mil a quarter. - Technical supports strong rebound to 148-160 range to test 200 SMA. Good setup for Q1 2025. - Downside risk is to 94-105 if it continues to meltdown.

Read MorePolkadot Rollup, Hyperbridge, Extends Initial Relayer Offering After Selling Over 52 Million Tokens

Zurich, Switzerland, January 17th, 2025, Chainwire Hyperbridge Extends Token Offering Deadline, Token Generation Event Set for Q1 2025 Following the successful launch of its...

Read MoreTether's Paolo Ardoino: 'If the U.S. Government Wanted to Kill Us, They Can Press a Button'

The leading stablecoin issuer is comfortable holding its T-bills at a U.S. institution because it …

Read MoreBitcoin's Triumph: 'Death Call' at $400 Proven Wrong

U.Today - Nine years ago, a "death call" was made for Bitcoin when its price was only $400. This negative prognosis, which predicted that Bitcoin was on the verge of collapse, has...

Read MoreHere’s What to Expect From J.M. Smucker’s Next Earnings Report

Switch the Market flag for targeted data from your country of choice. Open the menu …

Read MoreSpaceX Bitcoin (BTC) Now Holding $700 Million: Details

U.Today - American aerospace technology giant SpaceX has become one of the biggest beneficiaries of the ongoing Bitcoin (BTC) price boom. According to data platform Arkham...

Read More$1.23 Billion BTC Bhutan Government Shovels $65 Million in Bitcoin: Details

U.Today - Analytics account @lookonchain has spotted that one of the countries in the developing world that has recently embraced Bitcoin and several other cryptocurrencies for...

Read MoreBlackRock Bitcoin ETF Takes in $527 Million as BTC Eyes $103,000

U.Today - Institutional players on the cryptocurrency market are busy as the price of Bitcoin (BTC) soars in an attempt to hit $103,000. Notably, leading asset manager BlackRock...

Read MoreBitcoin ETF (BTC) Holding Reported by Atlanta’s Emory University

Grayscale’s mini BTC fund launched much later than its counterparts, after the asset manager’s flagship …

Read MoreWhat You Need to Know Ahead of Micron Technology’s Earnings Release

Switch the Market flag for targeted data from your country of choice. Open the menu …

Read MoreIf You Had Invested $1,000 in Coca-Cola When Warren Buffett First Invested in 1988, Here's How Much You'd Have Now

If You Had Invested $1,000 in Coca-Cola When Warren Buffett First Invested in 1988, Here's …

Read MoreVottun Brings Tokenization to Web3 Development; Launches Flagship Low-Code Platform for Builders

Barcelona, Spain, January 17th, 2025, Chainwire As an EU-licensed service provider, Vottun’s latest push for blockchain innovation through a ‘Code-to-Earn’ model...

Read MoreFast, Secure, and Seamless: Bybit Card QR Pay Set to Transform Payments in Brazil

Dubai, United Arab Emirates, January 17th, 2025, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has announced the launch of Bybit...

Read MoreMetaplanet becomes Asia’s second-largest corporate Bitcoin holder

Japanese investment firm Metaplanet has achieved a new milestone with its latest Bitcoin purchase, as …

Read MoreBitcoin 10x Surge Wasn't 'Pure Hopium' – Samson Mow Slams BTC Critics From Past

U.Today - Samson Mow, a vocal Bitcoin supporter and JAN3 chief executive officer, has published a tweet to take a jab at those critics who doubted BTC’s ability to skyrocket...

Read More