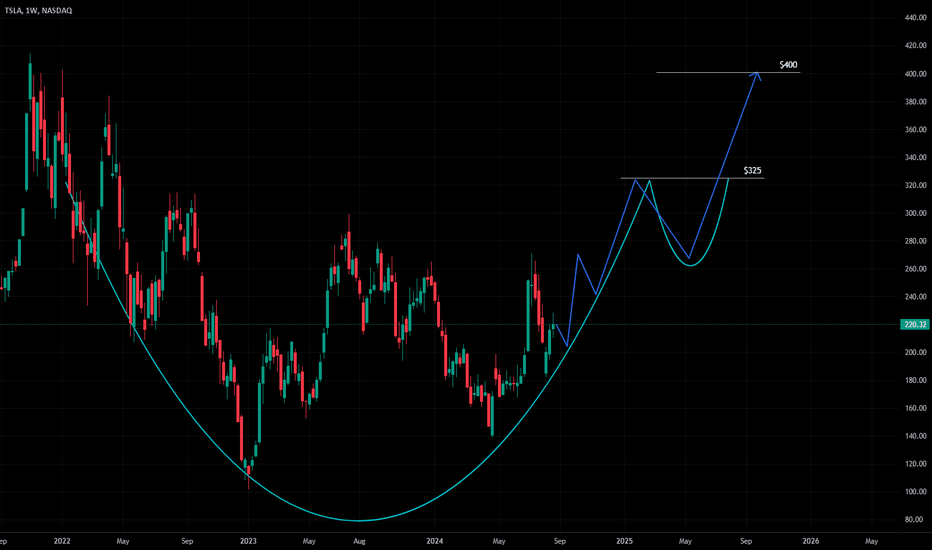

TSLA possible bottom + CUP & HANDLE formation. Targets Indicated

TSLA possible bottom + CUP AND HANDLE formation. This analysis is for informational purposes only.

Read MoreAlmost $400 Million Bitcoin (BTC) Transactions: Who Involved?

U.Today - In just two hours there were two enormous transactions on the Bitcoin blockchain that totaled over $380 million garnering. Whale Alert reports that 1,481 BTC ($142.8...

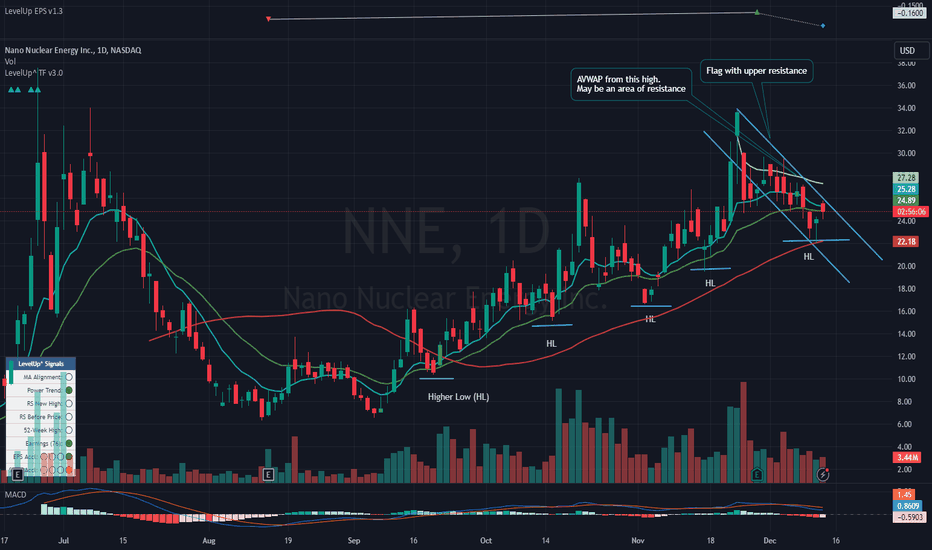

Read More$NNE Flagging and Ready to Resume Uptrend?

NASDAQ:NNE may be one for your watchlist. This one has had a nice uptrend since its IPO sell-off and has put in a series of Higher Lows (HL). It has just tested the 50 DMA (red) and has a nice green hammer candle off that area. It looks to be struggling with the 10 and 20 DMA’s right now. I have an alert set on the upper downtrend line. Should that trigger, I will go to a lower time frame chart to look for a good entry with a tight stop. There could be resistance at the AVWAP from the most recent high which is something to be aware of. In summary I am looking for this one to continue its uptrend after this shake-out and consolidation. All TBD.

Read MoreStorage-Focused Xenea Blockchain Opens Ecosystem Partnership Opportunities Ahead of Mainnet LaunchStorage-Focused Xenea Blockchain Opens Ecosystem Partnership Opportunities Ahead of Mainnet Launch

Dubai, United Arab Emirates, January 3rd, 2025, Chainwire Xenea, an EVM-compatible Layer 1 blockchain, has integrated decentralized storage to support dynamic data use cases,...

Read MoreSatoshi Nakamoto Launched Bitcoin This Date 16 Years Ago

U.Today - On Jan. 3, 16 years ago, Bitcoin, the first and largest cryptocurrency, officially launched after the Genesis Block was mined. The Genesis Block, also known as Block 0,...

Read MoreEOS Climbs 10% As Investors Gain Confidence

- EOS was trading at $0.9100 by 08:46 (13:46 GMT) on the Index on Friday, up 10.09% on the day. It was the largest one-day percentage gain since January...

Read MoreRecord $330 Million Outflow Hits BlackRock Bitcoin ETF as 2025 Begins

U.Today - BlackRock (NYSE:BLK)'s iShares Bitcoin Trust (IBIT) started 2025 with a big outflow of $332.6 million, which is about 3,413 BTC. This is the ETF's biggest single-day...

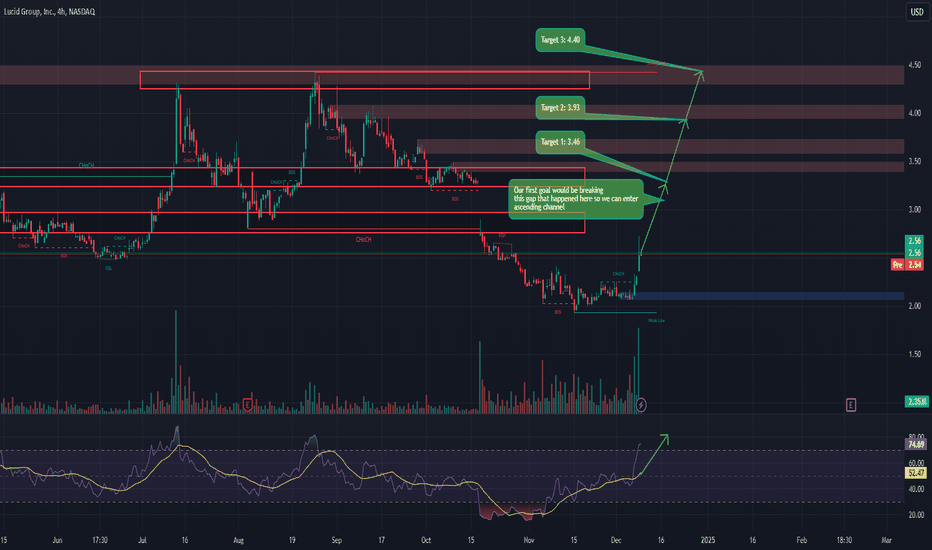

Read MoreLCID , I think we just need to ride the wave to success!

Hi dear traders, today we would look into Lucid Group. the luxury EV creator in the U.S. so far the company has had a very bumpy road in it's history and I am going to be honest with you I participted and caught some really good results with it , so this is why I am pointing my analysis. Fundamental POV - They are a leading EV company which is popular as we sad with their luxury Electric Vehicles.Recently its linep with the Gravity SUV and reported 200M Q3 revenue which surpassed expectations makes it a tasty opportunity.With confirmed production target of crossing 10,000 vehicles and a fresh funding of 1.75$ Billion Lucid is very well positioned to follow up with this bullish run. Entry - On market open - 2.61$ Target 1: 3.46$ (covering the huge gap) Target 2: 3.93$ going towards upper resistance level in a formulated ascending channel Target 3: 4.40$ surpassing the Resistance Level so we can see what we can aim for next. Keep in mind at a point in time this company's stock was 65$ per share, so we have a long road ahead of us , this overview is short/mid term. As always my friends happy trading! P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

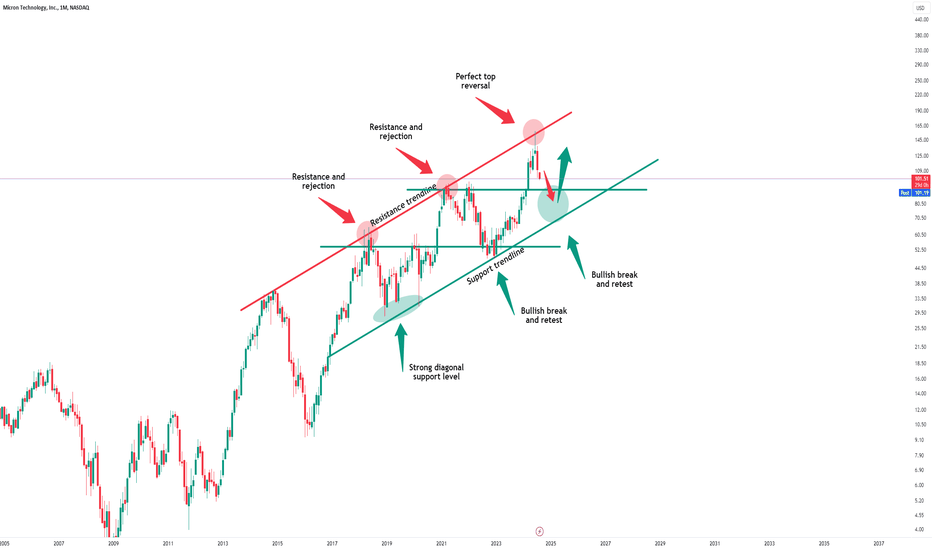

Read MoreMicron Technology - The perfect chart!

NASDAQ:MU is one of these stocks, which just respects every level, cycle and structure. If I would give each chart an individual rating, the chart of Micron Technology would be 10 out of 10. Micron Technology is actually respecting every structure level and providing textbook trading opportunities. If we get a retest of the previous all time high, which is now turned support and perfectly lining up with the support of the rising channel, I will certainly look for longs. Levels to watch: $90 Keep your long term vision, Philip - BasicTrading

Read MoreBlackRock’s spot Bitcoin ETF sees record daily net outflow of $333 million

-- BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) experienced its largest daily outflow since launching a year ago, coinciding with the resumption of U.S. trading...

Read MoreCardano Climbs 10% As Investors Gain Confidence

- Cardano was trading at $1.0271 by 01:05 (06:05 GMT) on the Index on Friday, up 10.12% on the day. It was the largest one-day percentage gain since...

Read MoreBitcoin price today: rises to $97k as new year rout eases; Tether hit by MiCA law

-- Bitcoin rose on Friday, extending a recovery from a price rout seen over the new year holiday as traders sought more clarity on the U.S. regulatory outlook under...

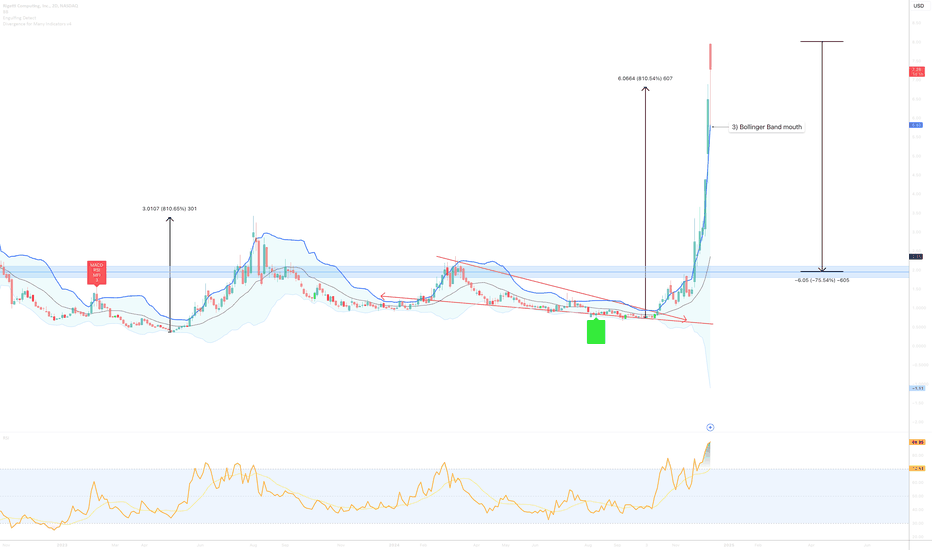

Read MoreRigetti Computing, Inc. to print a 70% market crash ??

** short trade - weeks ahead ** On the above 2 day chart price action has rocketed up 800% in the last 60 days. Now is a good moment to be “short”, why? 1) Price action meets flag forecast. 2) The forecast area is also monthly resistance. 3) Price action is multiple sigmas from the Bollinger Band Mean. Do not forget, 95% of all price action trades around the mean. 4) First support is around $2.35 5) Everyone else on tradingview is long. WW is a contrarian, that means he opposes popular opinion. www.tradingview.com Is it possible price action continues going vertical? Sure. Is it probable? No Ww Type: Short trade Timeframe for short entry: 48 hours Risk: You decide Return: 70%

Read MoreBitcoin Proves Jim Cramer's 'Scam' Remark Wrong, BTC Up 473%

U.Today - Bitcoin, the first and largest cryptocurrency by market capitalization, has increased by nearly 473% since Jim Cramer, host of CNBC's "Mad Money," labeled it a "scam"...

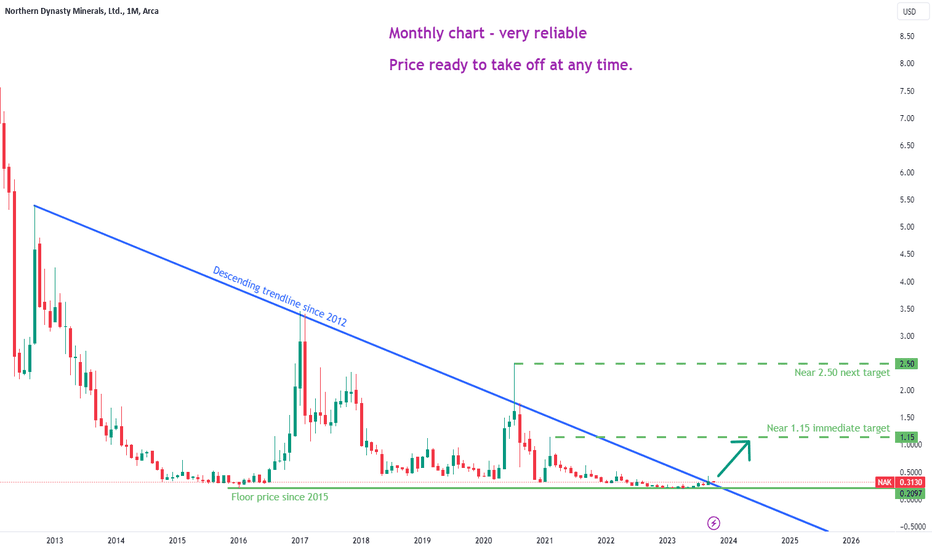

Read MoreNAK Long-Term BULLISH

This is on the monthly chart and very reliable . NAK is nearing a total breakout of a descending trendline in place since 2012. In confluence with this, NAK has been staying around it's floor price for months now. It looks ready to launch from this base. TP #1 = 1.15 (should be easy to reach) TP #2 = 2.50 (likely to be reached longer term) SL = 0.19 Current price at time of this post is 0.313 Risk is only $0.123 per share, while reward for TP#1 is $0.837 per share, but the potential for TP #2 is high and this would be a reward of $2.187 per share!

Read More