Acurast Unveils Processor Lite for iOS: Empowering iPhone Users to Join the DePIN Cloud Rebellion Secured by Polkadot

Zug, Switzerland, December 19th, 2024, Chainwire Acurast, a leader in decentralized confidential cloud computing, announces the launch of Acurast Processor Lite for iOS, now...

Read MoreLitecoin Falls 11% In Bearish Trade

- Litecoin was trading at $102.352 by 12:56 (17:56 GMT) on the Index on Thursday, down 11.37% on the day. It was the largest one-day percentage loss...

Read MoreBitcoin price to $62K? Bearish div hints at a slow start to Uptober

Bitcoin’s (BTC) monthly price chart is less than 48 hours away from completing a bullish …

Read MoreEthereum Falls 10% In Rout

- Ethereum was trading at $3,473.09 by 12:50 (17:50 GMT) on the Index on Thursday, down 10.31% on the day. It was the largest one-day percentage loss...

Read MoreWhiteBIT’s Institutional Focus Drives Trading Volume to Record $2.7 Trillion in 2024

Vilnius, Lithuania, December 20th, 2024, Chainwire Europe’s leading cryptocurrency exchange, WhiteBIT, concludes the year with notable achievements. The latest estimates...

Read MoreBoost VC Invests in PoSciDonDAO, Welcoming It to Their Go-To-Market Program

Panama City, Panama, December 19th, 2024, Chainwire PoSciDonDAO has announced that Boost VC has invested in the project, representing a significant step forward in its mission to...

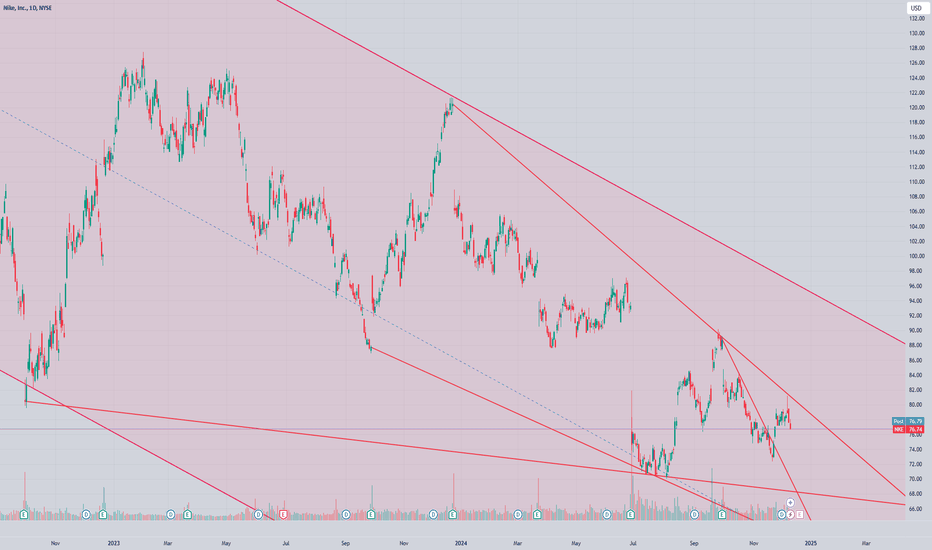

Read MoreI love the way $NKE is setting up.

I am long NYSE:NKE with a small/mid-sized position. I will add at three locations on this chart. 1. Approach/touch of the lower line. 2. Break of the downtrend. 3. Break of the down channel.

Read MoreKamala Harris promises to fight inflation

Democratic presidential candidate Vice President Kamala Harris and her husband, Doug Emhoff, stop at a …

Read Moreio.net Joins Dell Technologies Partner Program as Authorized Partner and Cloud Service Provider

Dubai, UAE, December 19th, 2024, Chainwire io.net, the leading provider of decentralized GPU computing solutions, has been accepted to join the Dell Technologies (NYSE:DELL)...

Read More131.2 Million SHIB Torched, But There's Big Catch Here

U.Today - The Shibburn data tracking platform has revealed that the SHIB community has succeeded in removing SHIB meme coins from circulation. However, there is nuance with this...

Read More6 AI applications already in use in the healthcare industry

Sam Altman, co-founder and CEO of artificial intelligence firm OpenAI, released an essay on Sept. …

Read MoreBybit x Block Scholes Crypto Derivatives Report: BTC at All-Time High, ETH Options Signal Momentum

Dubai, United Arab Emirates, December 19th, 2024, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, today released its latest crypto...

Read MoreHarbour Teams with Velocity Labs to Launch Instant Stablecoin Payment Between EU Banks and Polkadot

London, UK, December 19th, 2024, Chainwire Harbour, in partnership with Velocity Labs, announces the launch of their stablecoin payment system “Magic Ramp”, connecting...

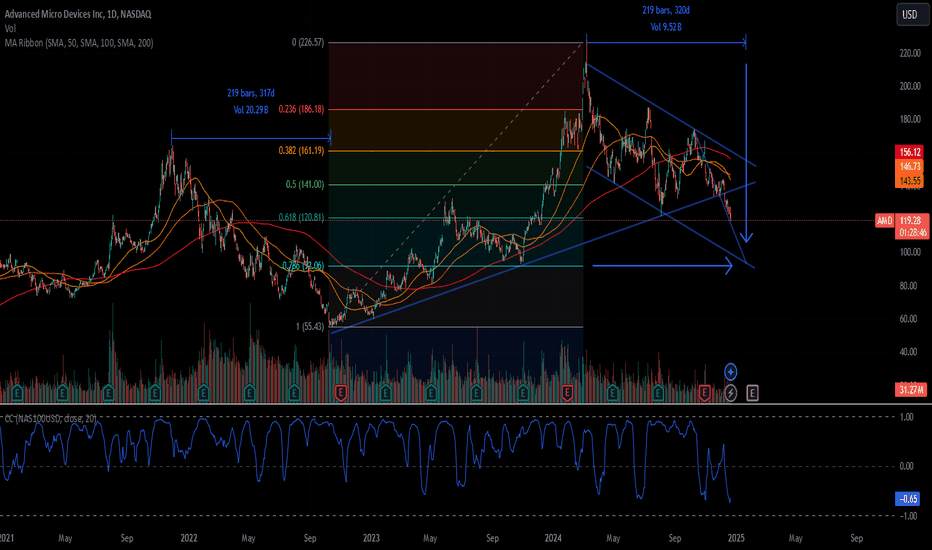

Read MoreAMD retracing

AMD broke the lower long term trend line with no substantial support until the next Fib retracement that matches prior support. If time trends hold, end of Jan '25 could potentially be the start of a new uptrend.

Read MoreBety.com Introduces Blockchain-Powered Transparency and Fairness to Online Gaming

Victoria, Seychelles, December 19th, 2024, Chainwire BETY.com is enhancing the online gaming and betting landscape by integrating blockchain technology and hash algorithms to...

Read More