French Prime Minister Gabriel Attal to tender resignation

France’s Prime Minister Gabriel Attal gives a speech following the first results of the second …

Read MoreElectric Vehicle Adoption Continues to Stall Out

The electric vehicle revolution is encountering significant hurdles as consumers grapple with high costs, infrastructure …

Read MoreNorth Carolina's CBDC ban bill vetoed by governor

Governor Roy Cooper was slammed for not putting “partisan politics aside” to support a law …

Read MoreSean ‘Diddy’ Combs returns to Instagram with video of private jet amid legal troubles: ‘No place like home’

Sean “Diddy” Combs returned to Instagram Friday, posting a video of himself boarding his private …

Read MoreNYC Neighbors Claim Tenant Runs Around Naked, Gives Children Nightmares

A man in Queens is making his neighbors crazy with terror due to his actions …

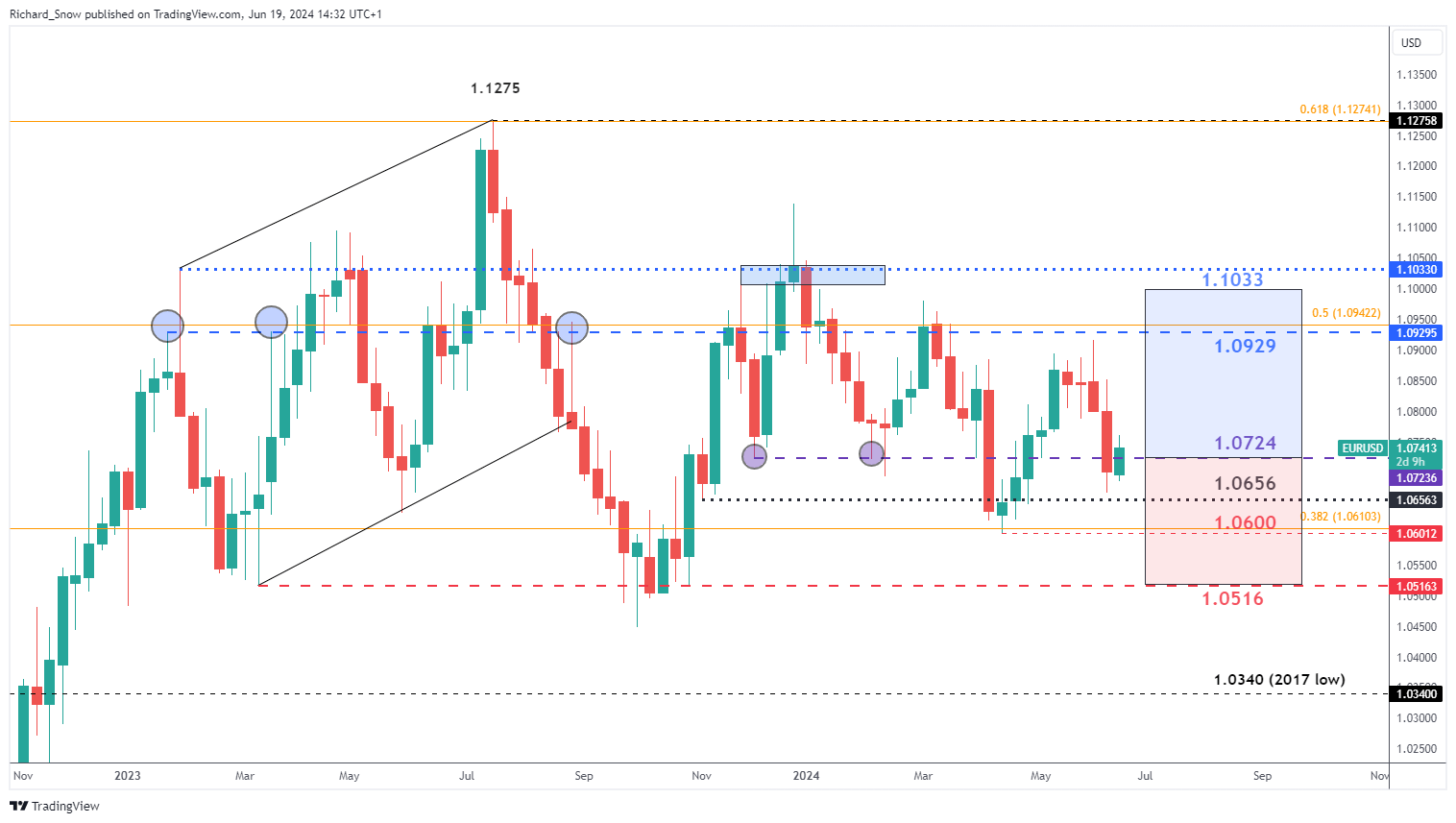

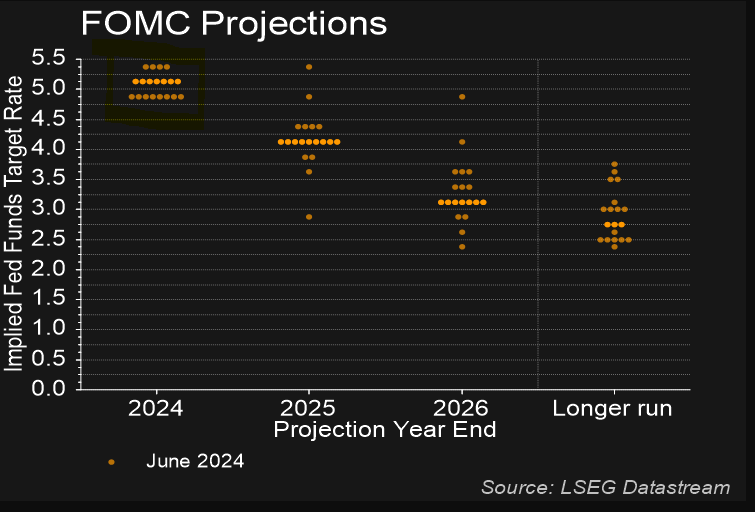

Read MoreGold Q3 Fundamental Forecast: Interest Rates, Central Bank Demand and Risk

Gold's Q3 direction hinges on rate shifts, reduced central bank purchases, the run up to the US election, and the continuation of major global conflicts

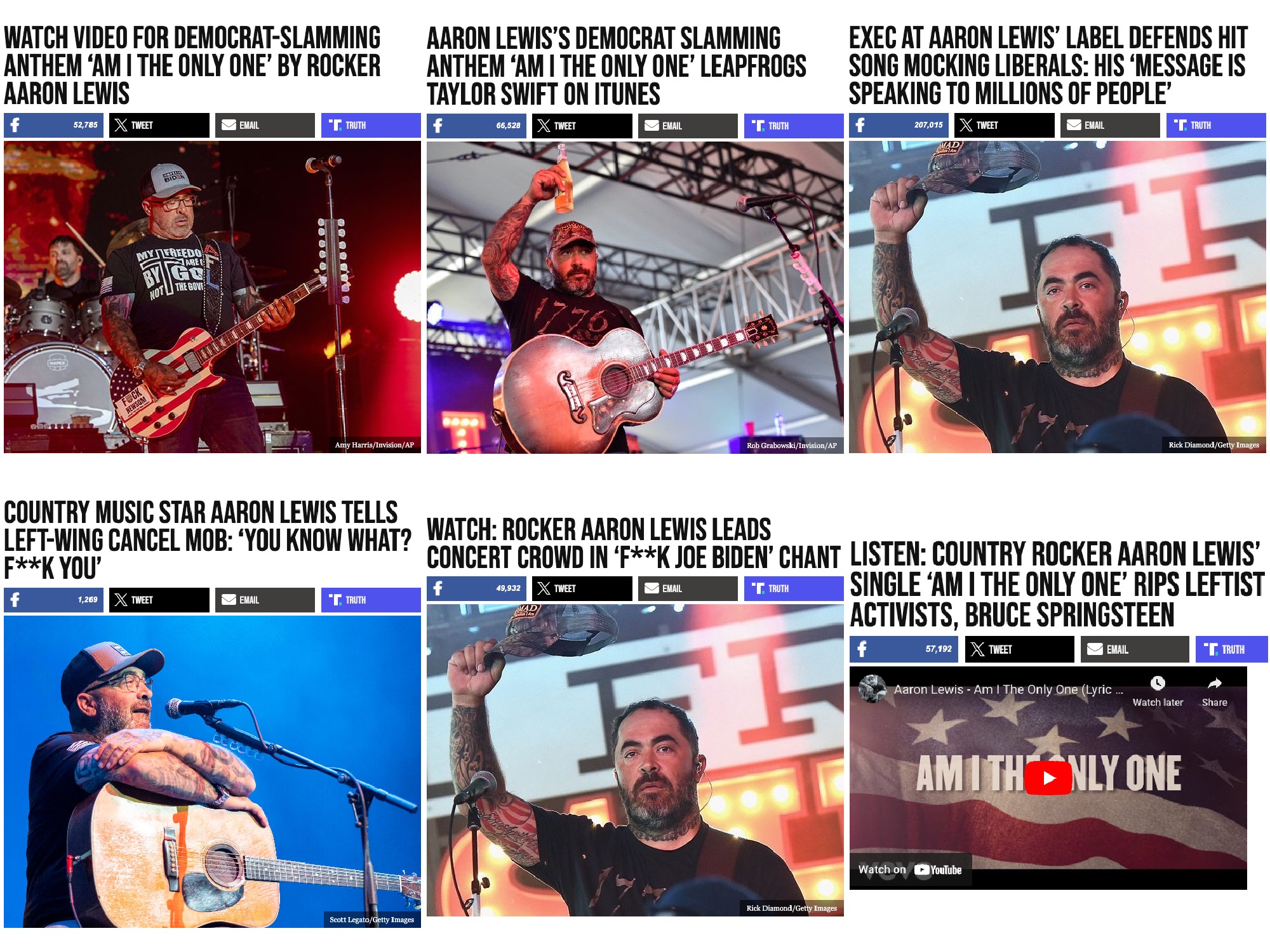

Read MoreHall of Fame Songwriter Jeffrey Steele Performs and Describes the Day Mega-Hit ‘Am I the Only One’ Was Written

“I’m not writing a song. It’s my day off.” That was Jeffrey Steele’s response when …

Read MoreCouples are having micro weddings as average cost now over $30,000

Vanessa Acosta marries Sam Roberts in their backyard in Pasadena, California, on May 25, 2024. …

Read MoreThe Holy Grail Cars? Get Them While They Last.

The news shocked the collector-car world. In May 2022, a 1955 Mercedes-Benz 300 SLR Uhlenhaut …

Read MoreBitfinex to refund investors of its failed El Salvador Hilton hotel project

Bitfinex intends to refund all investors but is firstly awaiting a potential new offer from …

Read MoreMost Students Say Biden Not Fit to Be President

A majority of students — both high school and college-age — believe President Joe Biden …

Read More3AC-linked wallet bought NFT for $59K due to 3-year-old offer that wasn’t canceled

Arkham data shows that a wallet belonging to failed hedge fund 3AC spent $59,000 on …

Read MoreTesla shares wipe out loss for the year with 27% rally this week

Elon Musk attends ‘Exploring the New Frontiers of Innovation: Mark Read in Conversation with Elon …

Read More