UK Regulator FCA Arrests Two People Associated With $1.3B Illegal Crypto Business

“The FCA has an important role to play in keeping dirty money out of the …

Read MoreDarden Restaurants (DRI) Q4 2024 earnings

Olive Garden Italian restaurant sign showing company logo, Spokane Valley, Washington, owned by Darden Restaurants …

Read MoreDogecoin (DOGE) Prices Fall as Traders Bet Against Token, “Memecoin Summer on Hold,” Some Say

“When the price of Bitcoin falls, memecoins tend not only to follow, but to lose …

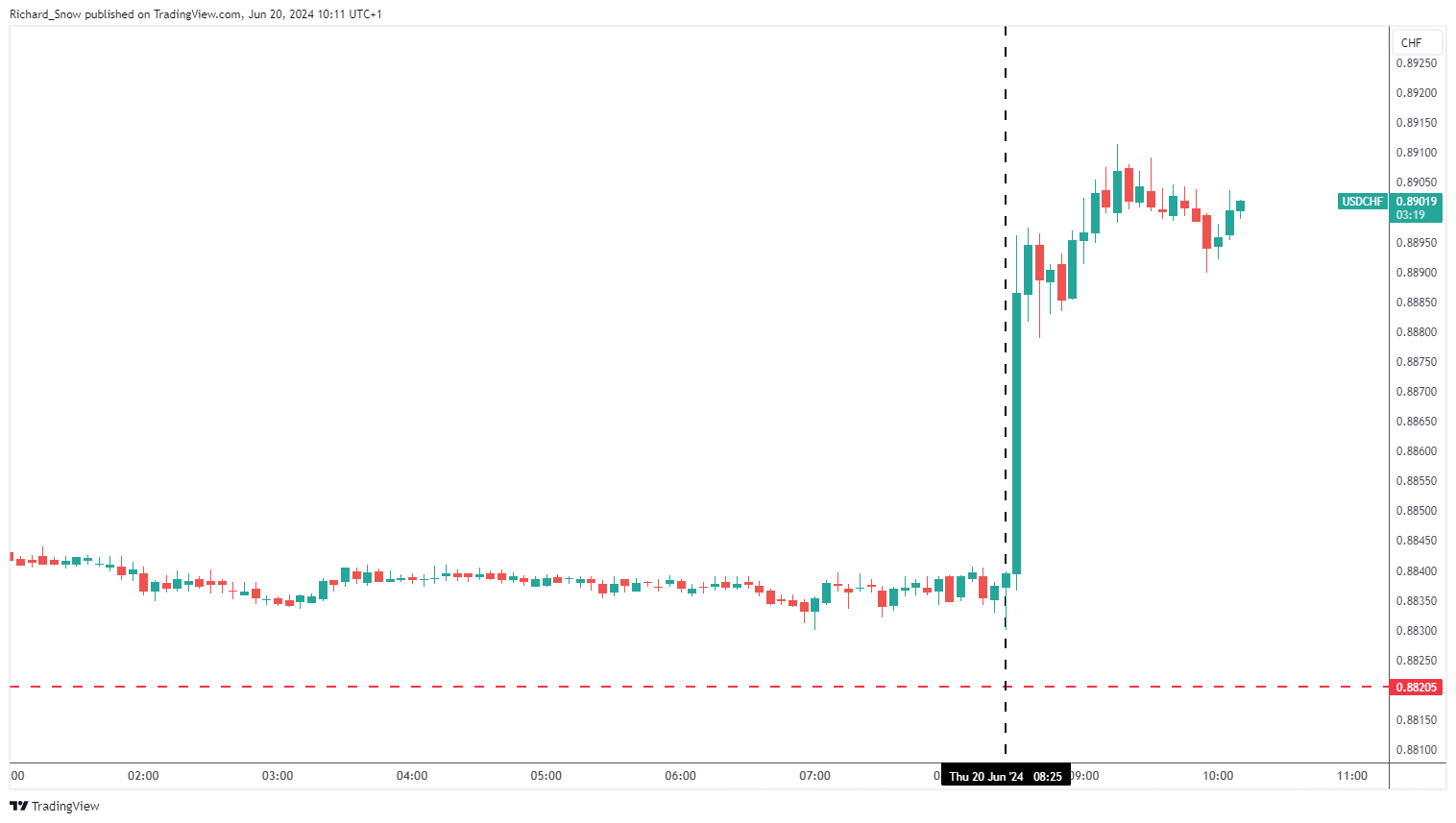

Read MoreSwiss National Bank Cuts Rates, Cites Strong Franc as it Looks to Fuel Growth

The Swiss National Bank voted to lower its policy rate, following on from March’s surprise cut. Inflation is expected to remain well below the 2% target, stabilising at 1%

Read MoreDilemma on Wall Street: Short-Term Gain or Climate Benefit?

A team of economists recently analyzed 20 years of peer-reviewed research on the social cost …

Read MoreBinance Fined $2.2 Million by India’s Financial Intelligence Unit

Binance, the world’s largest cryptocurrency exchange, has been fined approximately $2.2 million (18.82 crore INR) …

Read MoreMother of fallen Connecticut detective rallies behind significance of ‘thin blue line’ flag

Join Fox News for access to this content You have reached your maximum number of …

Read MoreAnalyst Says XRP Price Is Long Overdue For Bullish Wave, Here’s The Target

The XRP price has struggled in the market over the past year and has failed …

Read MoreJon Rahm blames announcers for Rory McIlroy critics after they ‘severely underplayed’ putt difficulty

There has been a wave of critics who believe Rory McIlroy just had to hit …

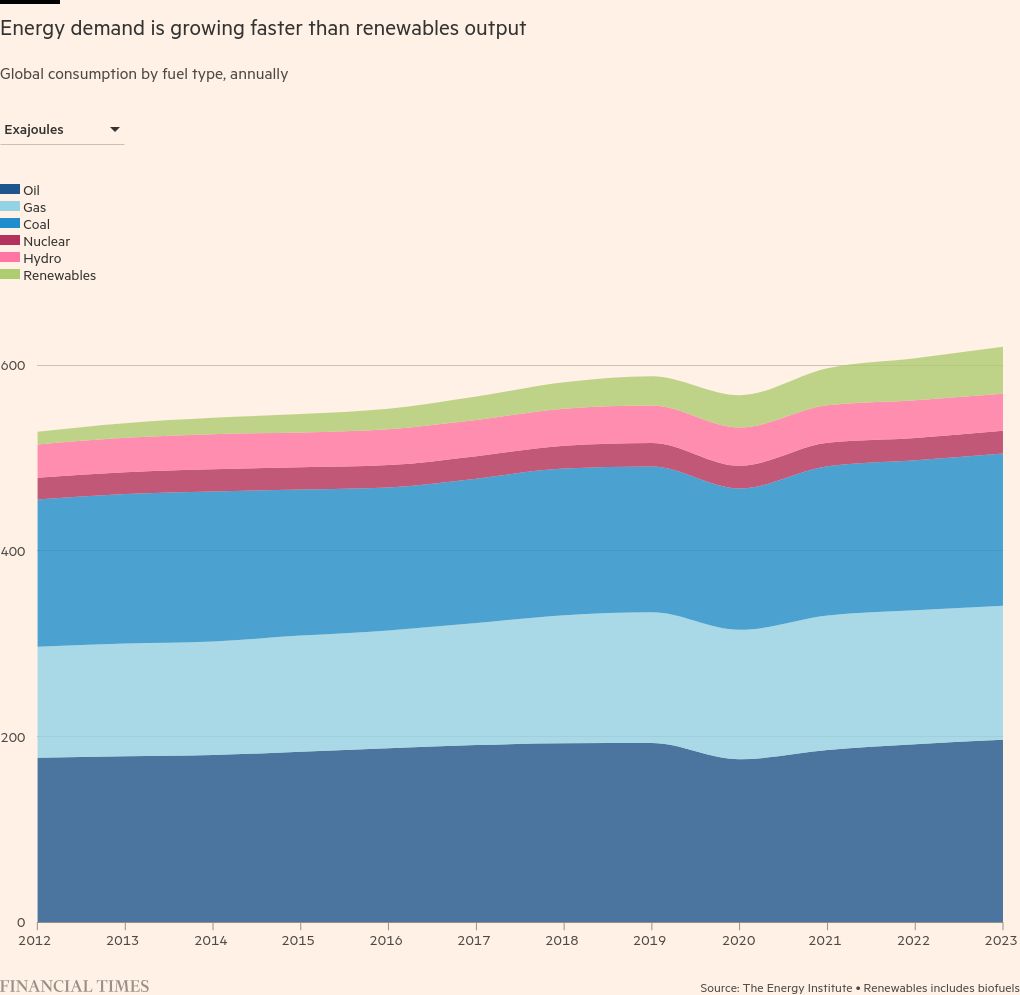

Read MoreEnergy emissions hit record high on rising fossil fuel demand, says report

Stay informed with free updates Simply sign up to the Energy sector myFT Digest — …

Read MoreBill and Hillary Clinton tap into their money men for Biden’s battle against Trump

Join Fox News for access to this content Plus special access to select articles and …

Read MoreThe Importance of Diversifying Digital Asset Portfolios for Optimal Returns

Expand to an actively managed portfolio encompassing tokens from the Top 150 by market cap …

Read MoreAPhone introduces DApp store combining Web2 and Web3 apps

The alternative DApp store wants to offer features for Web3 enthusiasts while focusing on due …

Read MoreRepublican lawmakers say what is really behind Biden’s ‘amnesty’ order and more top headlines

Good morning and welcome to Fox News’ morning newsletter, Fox News First. Subscribe now to get …

Read More