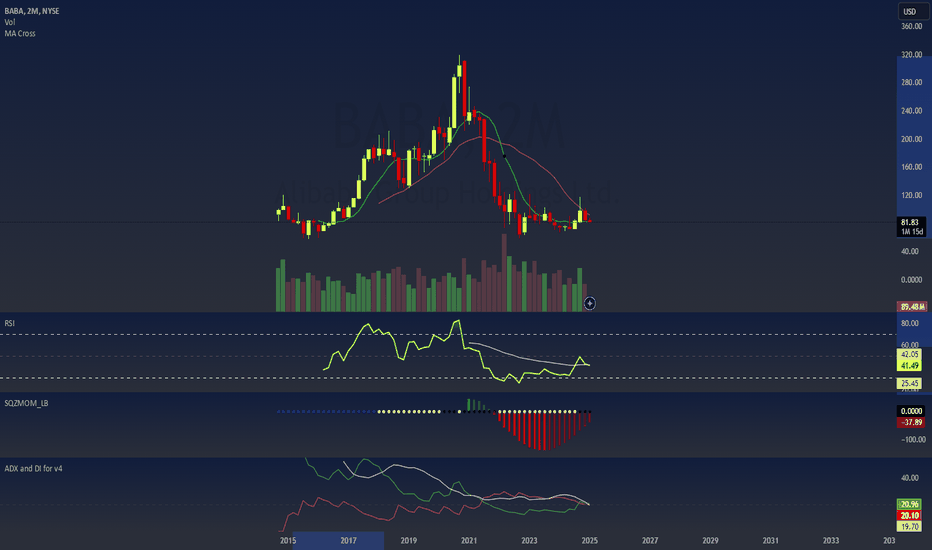

$BABA Massive Support Bounce

Alibaba Group Holding Limited (BABA) presents a compelling investment opportunity for 2025, supported by several key factors: Analyst Projections: Analysts maintain a "Strong Buy" consensus for Alibaba, with an average 12-month price target of $125.40, indicating a potential upside of approximately 55.72% from the current price. Strategic Investments and AI Integration: Alibaba's strategic investments, particularly in artificial intelligence (AI), are expected to drive growth in its e-commerce and cloud computing segments. The integration of AI-powered tools and services positions the company to capitalize on emerging technological trends. International Expansion: The company's international and logistics segments have experienced revenue growth, reflecting Alibaba's efforts to expand its global footprint. This diversification enhances its revenue streams and reduces dependence on the domestic market. Valuation and Market Position: Despite recent stock performance, Alibaba is considered undervalued compared to its peers, trading at conservative multiples. Its dominant position in e-commerce and cloud services, coupled with substantial cash reserves, underscores its potential for a market rebound. In summary, Alibaba's favorable analyst outlook, strategic investments in AI, international expansion, and attractive valuation suggest that BABA is a promising investment for 2025.

Read MoreBitcoin price to hit $250,000 by the end of 2025: Tom Lee

-- Bitcoin could soar to $250,000 by the end of 2025, according to Tom Lee, Head of Research at Fundstrat Global Advisors. Despite recent fluctuations, Lee maintains...

Read MorePurple Bitcoin ($PBTC): A Community-Driven Token Designed for Investors and Built for Growth

New York City, United States, January 14th, 2025, Chainwire Purple Bitcoin ($PBTC) is an emerging new token set to redefine the digital asset space. Built on the Solana...

Read MoreGenius Group Announces $33M Rights Offering to Increase Bitcoin Treasury

Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading AI-powered, Bitcoin-first education group, announced today that its Board of Directors (the...

Read More$DOGS token and TON blockchain shine in CoinMarketCap's 2024-2025 Yearbook

-- CoinMarketCap recently revealed its 2024-2025 Yearbook, focusing on the year's significant advancements and standout projects in the cryptocurrency industry. The...

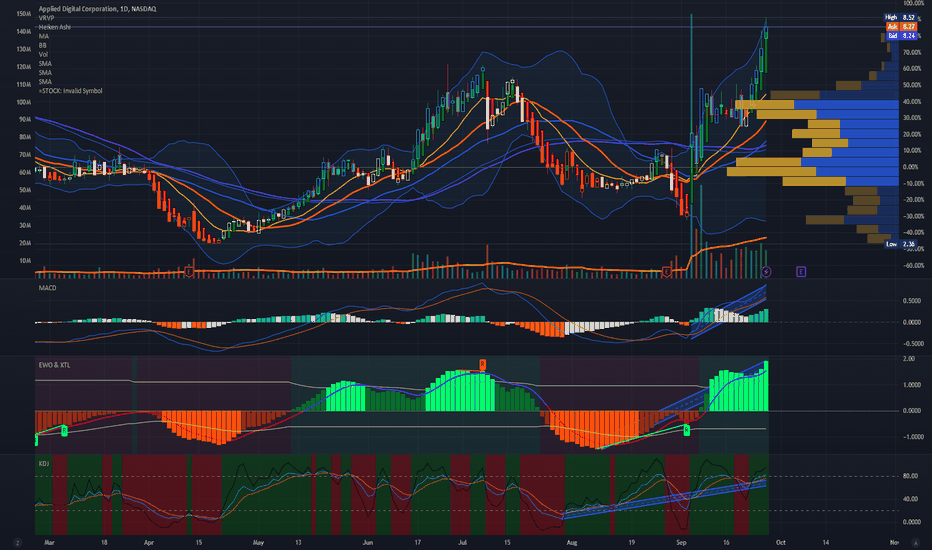

Read MoreAPLD

Graph with MACD cross and rising KDJ and EWO all bottoms up bootstraps with large volume spike on Sept 3rd on a 4D chart shows strap in. Upcoming earnings target is -0.273 and past earnings have been off, so the recent jump has gained >100% for the big whale buyer. #chart #EWO #quick100% #APLD #largevolumespike 4d chart #KDJ cross-over trend #MACD trend Too late? No buy or sell recommendations here. Make own decision on next earnings announcement.

Read MoreRussia-Ukraine drawing South and North Korea troops unlikely to spike regional conflict

Smoke rises after North Korea blows up sections of inter-Korean roads on its side of …

Read MoreA truly decentralized system would decentralize authority — Cardano exec

While decentralized governance may reflect the ethos of Web3 systems, a Cardano Foundation executive said …

Read MoreXRP Climbs 10% In a Green Day

- XRP was trading at $2.5778 by 07:01 (12:01 GMT) on the Index on Tuesday, up 10.09% on the day. It was the largest one-day percentage gain since...

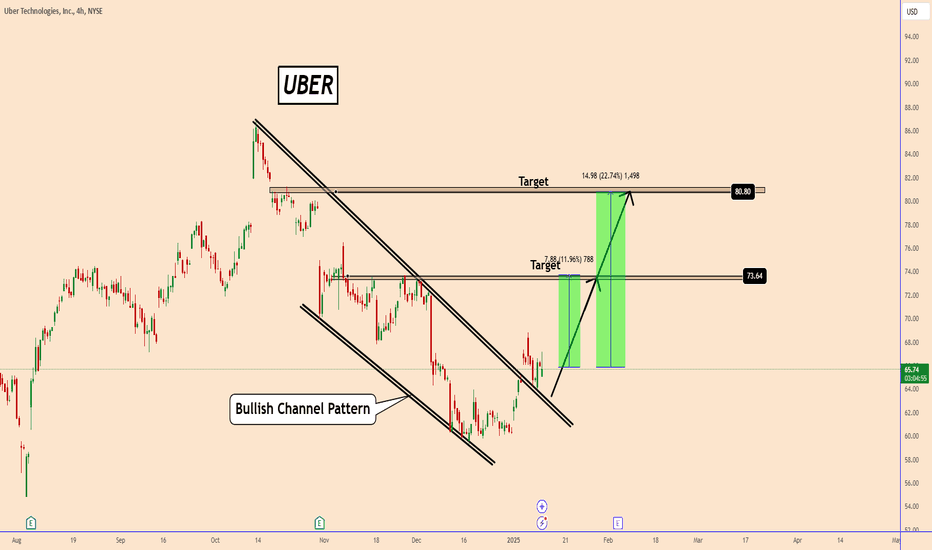

Read MoreUBER In-Depth Analysis with a Bullish Bias

UBER In-Depth Analysis with a Bullish Bias UBER has just broken out of a clear Bullish Channel pattern. The price is poised to rise again ahead of the earnings report set to be released on February 5th. For further details, you can watch the full analysis! Thank you:)

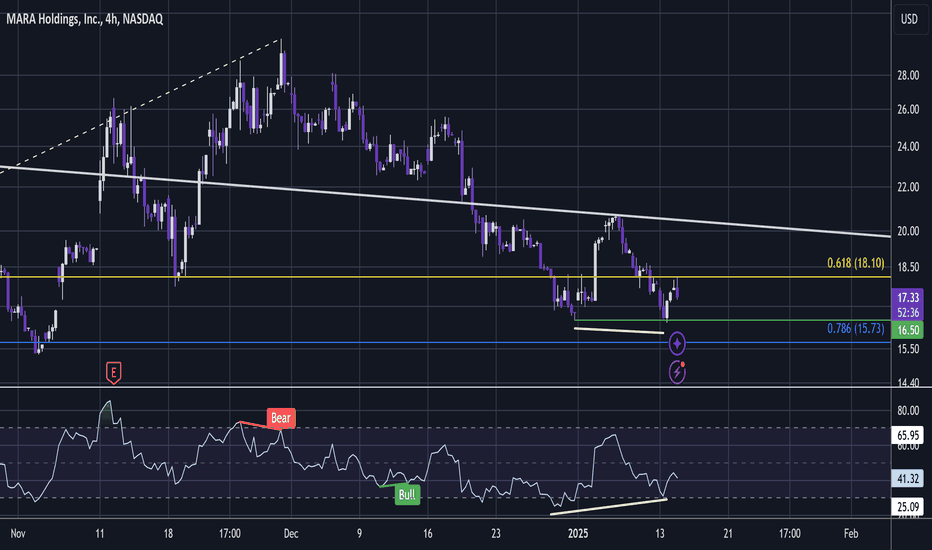

Read MoreMARA - Ideal Dip Is HERE!

MARA Has been slumping for quite a while, and now a Wyckoff slightly lower low just printed with bullish divergence coming in. Its also nicely within the retracement Golden Window; the most likely ratio area for a bullish pivot. So this is now an ideal position to buy! A conservative approach would be to wait to see if Bitcoin prints a retracement Golden Window slump. But chart on its own merit; it looks a great long opportunity right here 👍. Not advice

Read MoreDonald Trump Win Odds Spike to 99% on Polymarket For One Trader

The “GCorttell93” account purchased over 4.5 million Trump contracts in the “Presidential Election Winner 2024” …

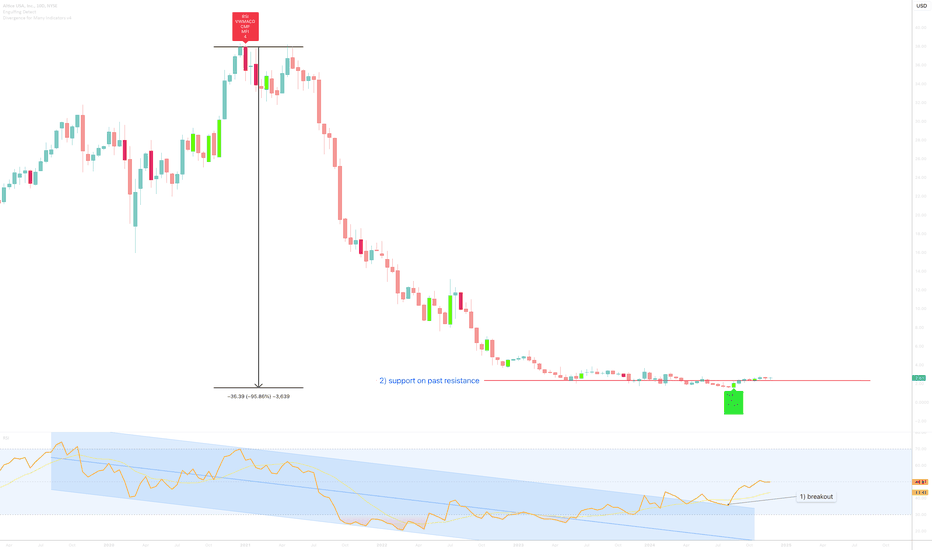

Read MoreAltice USA, Inc to print disturbing gains of 500% ??

** For the active investor — weeks and months ahead ** On the above 10 day chart price action has corrected 95% from $38 to $1.65 without the aid of stock splits. A number of reasons now exist to enter a long position. They include: 1) Price action and RSI resistance breakouts. 2) Support on past resistance confirms. 3) Regular bullish divergence. Multiple oscillators print positive divergence with price action over a 3 month period. 4) No stock splits! 5) 10% short interest.After 95% correction, good luck with that. Is it possible price action continues to correct? Sure. Is it probable? No. Ww Type: Investment Risk: You decide, please do you’re own due diligence Timeframe for long: This year. Return: 400-500%, no significant resistance until $12 Stop loss: elsewhere

Read MoreIntesa Sanpaolo makes first spot Bitcoin purchase

-- Intesa Sanpaolo (OTC:ISNPY) SpA, Italy's largest banking group, has purchased Bitcoin for the first time in a spot transaction. The bank bought approximately 1...

Read MoreToo early to say Ethereum L2s are ‘cannibalistic’ to revenue: Sygnum Bank

Fears that Ethereum layer 2 scaling solutions are eating into the mainnet’s revenue and could …

Read More