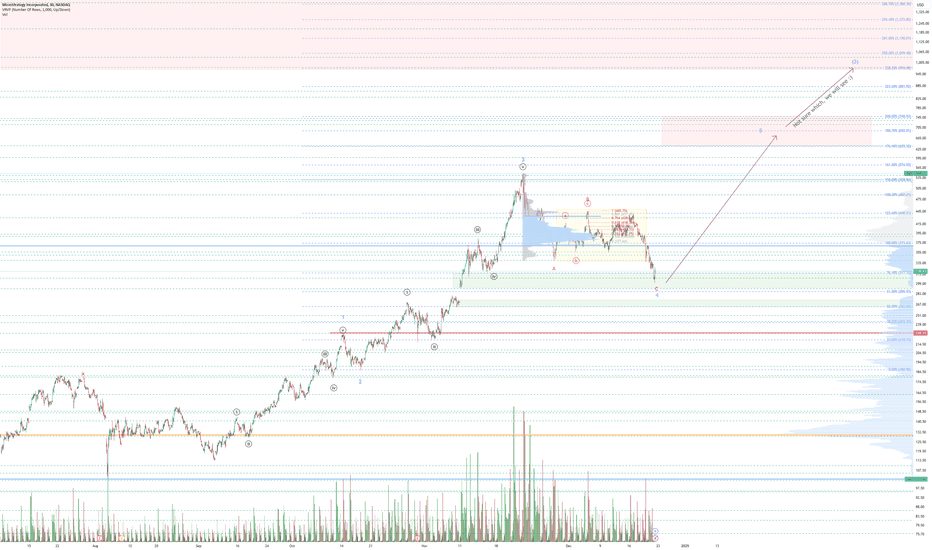

MSTR - Can I BUY now?

NASDAQ:MSTR seems to have found a base at my ideal target for w4. (Would have been great if I managed to publish it ;/) To keep this brief, I like this area as a base before finding higher. Goo dLuck!

Read MoreSatoshi's First Move: 16 Years of Bitcoin's Legacy

U.Today - On Jan. 12, 2009, a groundbreaking milestone occurred that would forever change the landscape of digital finance. Satoshi Nakamoto, Bitcoin's pseudonymous creator(s),...

Read MoreKey Bitcoin Driver Linked to Current Price Correction Revealed by Max Keiser

U.Today - Max Keiser, a prominent Bitcoin maximalist and currently the BTC advisor to El Salvador’s president Nayib Bukele, has shared his take on why Bitcoin keeps tanking...

Read MoreHere's Why Bitcoin (BTC) Is Unlikely to Break $100,000

U.Today - Though the current state of the market indicates it may not happen anytime soon, Bitcoin's journey to $100,000 has been a hot topic. The $60,000-$70,000 range that...

Read MoreCardano Falls 11% In Rout

- Cardano was trading at $0.8869 by 09:34 (14:34 GMT) on the Index on Monday, down 10.54% on the day. It was the largest one-day percentage loss since...

Read MoreBYDFi Launches Innovative Perpetual Contract Copy Trading Feature, Welcomes Global Traders to Join

Victoria, Seychelles, January 13th, 2025, Chainwire BYDFi, a global leader in cryptocurrency trading, announces the launch of its innovative Perpetual Contract Copy Trading...

Read More3 Bitcoin Price Scenarios That Could Shape 2025 Unveiled by Peter Brandt

U.Today - The beginning of the new year 2025 can hardly be called prosperous for the cryptocurrency market. First, the price of Bitcoin (BTC) teased us with a new all-time high...

Read MoreTrader Warns of Correction as BTC Dominance Reaches 2021 Levels

“Ethereum continues to lose market share to bitcoin and other altcoins. As a result, BTC’s …

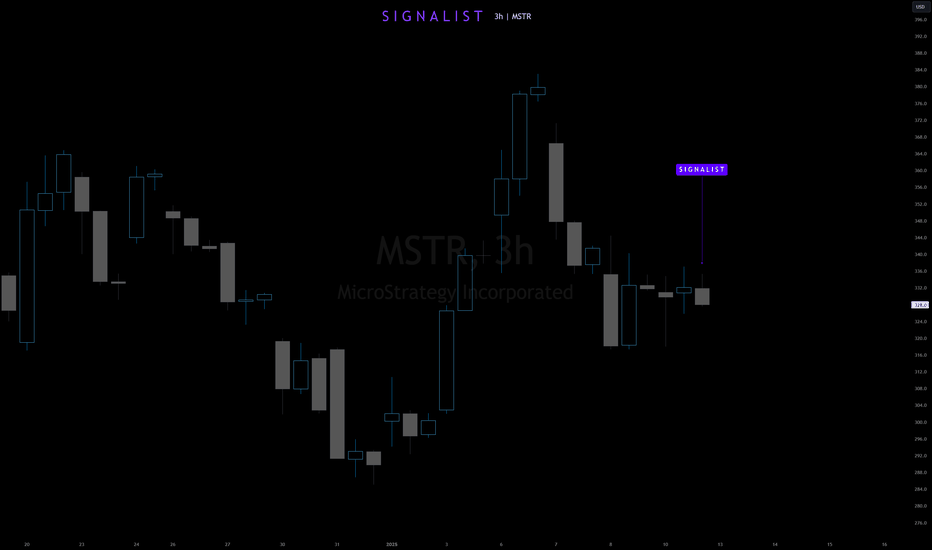

Read MoreMajor Price Movement Incoming for MSTR!

Signalist has detected a precise pattern in NASDAQ:MSTR trading activity, signaling that a substantial price movement is imminent. This isn’t a random fluctuation—it’s a carefully analyzed precursor to a significant market event. 📅 What to Expect: ⌛ Timeline: Anticipate a major move within the next 1 to 4 upcoming 3-hour candles. 📈 Monitor the Charts: Keep an eye on MSTR’s price action over the next few candles. Prepare Your Strategy: Whether you’re bullish or bearish, have your trading plan ready to capitalize on the move.

Read More$MRNA to $90-115 | 100-150% upside in FY 2025

- NASDAQ:MRNA most of the people are familiar with the vaccine stocks from pandemic fiasco. - This company is beaten down to the ground and has low market cap as compared to other biopharma stocks. - 2025 would be easier for merger and acquisition which will be good for moderna as it might get acquired by other biopharma companies to accelerate their growth. - Bird Flu in the US and rise of HPMV in China will create an upward pressure in terms of demand of these stocks. Monitor the news for HPMV as it seems it is more severe than the COVID

Read MoreJailed crypto scammers blew stolen funds on shark tank, hookers: Report

Five people have been sentenced to prison for their roles in a $21.6 million crypto …

Read More‘It’s Pissing Me Off’ Trump ‘Gets to Be Lawless’ While Harris ‘Has to Be Flawless’

CNN contributor and former Obama adviser Van Jones said Wednesday following his network’s presidential town hall …

Read MoreDonald Trump Leading Kamala Harris Nationally by Three Points

Former President Donald Trump is leading Vice President Kamala Harris nationally by three points in …

Read MoreBitcoin price today: falls for 3rd straight day to $94k on Fed rate jitters

-- Bitcoin edged lower on Monday, falling for a third straight day as stronger-than-expected U.S. payroll data stoked caution among traders, reinforcing the Federal...

Read MoreEnormous XRP Breakout to Launch Skyrocketing Rally, Shiba Inu (SHIB): Pattern You Don't Avoid, Bitcoin (BTC) Still Sleeping

U.Today - Finally, XRP has breached a crucial descending trendline resistance level, suggesting that a major bullish rally may be about to begin. After weeks of consolidation...

Read More